24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , lithium forklift battery manufacturer

With the rapid development of lithium-ion batteries in recent years and the strong promotion of national policies, we all believe that it is the era of lithium-ion batteries, and traditional batteries such as lead-acid batteries have long been eliminated. If you think so, you must have been deceived by the strong praise of the national policy. In fact, Xiao Bian thought so before the study (covering his face). But now it is still the world of lead-acid batteries. At least in the next few years, lead-acid batteries will occupy a stable position. Now let's take you to re understand the real lead-acid battery industry!

Overview of lead-acid battery industry

Technical level and characteristics of the industry. With the gradual increase of environmental protection verification and the gradual deepening of the implementation of the Specification Conditions, the lead-acid battery industry will further improve the access threshold, eliminate backward production capacity, basically realize mechanized manufacturing, and effectively improve the technical level.

The unique business model of the lead-acid battery industry: first, the procurement model. Lead acid battery enterprises generally purchase on demand based on the order. As lead accounts for a large proportion of raw material procurement and occupies a large amount of funds, industry enterprises generally establish a closer cooperation relationship with large lead smelting enterprises, and some purchase through bulk commodity agents. Second, production mode. Enterprises in the industry generally adopt the production mode of "production based on sales", and some products with common specifications are set with a certain safety stock. Third, the sales model. The plate products are mainly sold to domestic lead-acid battery manufacturers. The products of enterprises in the lead-acid battery industry are generally sold at home and abroad. Domestic sales are mainly directly sold to communication operators, UPS manufacturers, emergency electrical appliance manufacturers, etc. The automobile starting maintenance market and electric bicycle maintenance market generally adopt the distribution mode. Foreign sales are mainly sold to foreign traders, or directly sold to communication operators and UPS manufacturers by establishing local offices.

The cyclical, regional and seasonal characteristics of the industry. The periodicity of lead-acid battery industry is not obvious. On the one hand, lead-acid batteries are widely used in transportation, communication, electric power, railway, special, computer, scientific research and other fields, and are the basic products of the national economy. On the other hand, lead acid battery has a certain service life and needs to be replaced regularly, which determines the rigidity of its demand. The lead-acid battery industry has no obvious regional characteristics, mainly because it is the basic product of the national economy. The seasonality of the primary market (supporting market) of lead-acid batteries is not obvious, while the secondary market (replacement market) has a certain difference between light and peak seasons. Due to the drop of temperature in autumn and winter, the capacity and performance of outdoor batteries are reduced due to the impact of temperature, and the replacement demand is increased compared with that in spring and summer.

The relationship between lead-acid battery industry and upstream and downstream industries. The upstream industries of lead-acid batteries mainly include lead smelting industry, lead traders (bulk commodity agents), sulfuric acid production, plastic manufacturing, etc. Lead acid battery is the basic product of national economy, which is widely used in transportation, communication, power, railway, special, computer, emergency equipment and other fields. With the development of economy and technology, the demand for lead-acid batteries in these industries is increasing. At the same time, the technical level of lead-acid battery is constantly improved, the product quality and performance are also constantly improved, the application field is constantly expanding, and the demand of downstream industries is constantly emerging. With the establishment and improvement of the lead acid battery recycling system, the lead acid battery industry chain will form a benign closed-loop structure of "resources - products - renewable resources", which is expected to become a resource saving circular development industry.

Classification of lead-acid batteries: According to the application field, lead-acid batteries in China can be mainly divided into four categories: backup power battery, energy storage battery, starting battery and power battery. The backup power battery is mainly used for communication backup power supply, uninterruptible power supply (UPS), emergency lighting power supply and other backup power supplies. Energy storage battery refers to the battery used for energy storage for solar power generation equipment, wind turbines and other renewable energy. Starting battery is mainly used for starting, ignition and lighting of automobiles, motorcycles and fuel engines. The power battery is mainly used as power for electric bicycles, electric special vehicles (electric tour buses, golf carts, patrol cars, forklifts, etc.), low-speed electric passenger vehicles, hybrid electric vehicles and other electric vehicles.

Analysis of supply and demand of lead-acid battery industry

In 2017, the global lead-acid battery market size was about 42.9 billion US dollars (up 1% year on year), and it is expected to maintain a growth rate of 1% in the next five years. In the global market, lead-acid batteries occupy a leading position in the battery market due to their mature technology, high safety, high recycling efficiency, applicable temperature bandwidth, stable voltage, good combination consistency and low price. In 2017, the global lead-acid battery market was about 42.9 billion US dollars, up 1% year on year. However, environmental problems will be the key factor affecting the future lead-acid battery market. The production process of lead-acid batteries uses a large amount of heavy metal lead. If the pollutant emissions cannot be effectively controlled, it will cause adverse effects on the environment. The development of lead-acid batteries is facing greater public pressure. The lead consumption of lead-acid batteries in the United States accounts for more than 95% of the total lead consumption in the country. Due to sound laws and effective management, the lead emissions from the production of lead-acid batteries account for only 1.5% of the total emissions. In 2008, the United States government has excluded the production of lead-acid batteries from the main lead pollution sources. In addition, reducing vehicle emissions and improving fuel efficiency will also lead to changes in the automotive lead-acid battery market, which is expected to maintain a growth rate of 1% in the next five years.

In 2015, the global market share of lead-acid batteries was 54.67%, which is expected to grow slowly in the next few years. As the battery type with the largest market share in the world, the global market size of lead-acid batteries is expected to continue to grow. In 2015, the global lead-acid battery market grew by 1.57% compared with the previous year, reaching US $43.208 billion. It is expected that the growth rate will be basically 1% - 2% in the next five years. From the perspective of the global supply of lead-acid batteries, the shipment of lead-acid batteries in 2015 increased by 2.75% over the previous year, reaching 468 million kVAh. It is estimated that the shipment in the next five years will maintain a growth rate of 2% - 3%.

China is the world's largest producer, consumer and exporter of lead-acid batteries. China's lead-acid battery industry mainly implements the production based on sales. The production quantity of lead-acid batteries minus the export quantity is roughly the domestic consumption quantity. From 2005 to 2016, the output of lead-acid batteries of domestic enterprises showed a fluctuating growth, with a compound annual growth rate of 10.17%. 2014 was the highest point, and then the output began to slow down due to the impact of lithium ion batteries.

Current situation of lead acid battery market competition

The output of lead-acid batteries in China ranks first in the world, and the output of starter type batteries accounts for half of that of lead-acid batteries. From the perspective of the global production capacity of lead-acid batteries, China is a major producer, accounting for about 45% of the world's output, followed by the United States, accounting for about 32%, Japan ranked third, accounting for nearly 13%, and Germany. The leading manufacturers of lead-acid batteries in the world mainly include the American Riot Group, EXIDE Group (including the German Sunshine Company), Japanese Tangqian Company, Seandi Company and Panasonic Company. Lead acid battery is the battery product with the largest output in the world, accounting for 50% of all batteries and 70% of rechargeable batteries. Even the most developed countries and regions in the world, such as Europe, America and Japan, still produce and use lead acid batteries in large quantities. In the lead acid battery product structure, the starting type lead acid battery accounts for the largest proportion, reaching 48%, followed by the power type lead acid battery, accounting for 28%, and the standby and energy storage type lead acid batteries account for 15%.

Barriers to lead-acid battery industry

Policy barriers: According to the relevant provisions of the Regulations of the People's Republic of China on the Administration of Production License for Industrial Products, the Implementation Measures of the Regulations of the People's Republic of China on the Administration of Production License for Industrial Products, and the Detailed Rules for the Implementation of Production License for Lead Acid Battery Products, battery manufacturers must obtain the National Industrial Product License issued by the General Administration of Quality Supervision, Inspection and Quarantine of the People's Republic of China before they can carry out production. In addition, according to the Standard Conditions for the Lead Acid Battery Industry (2015 edition) issued by the Ministry of Industry and Information Technology, enterprises in the lead acid battery industry should meet the standard conditions in terms of enterprise layout, production capacity, construction projects that do not meet the standard conditions, processes and equipment, environmental protection, occupational health and safety production, energy conservation and recycling, and manage the production license, credit financing and other aspects of the lead acid battery production projects based on the standard conditions.

Technical barrier: ordinary open type lead-acid batteries are listed as eliminated light industrial products. At present, the development focus of lead-acid batteries is valve controlled sealed maintenance free lead-acid batteries. Industry enterprises, especially large manufacturing enterprises, always pay attention to R&D investment, constantly improve product quality and quality consistency, and reduce the rate of defective products and production costs. In the future, the development direction of new lead-acid batteries is to reduce lead consumption, improve battery mass energy density, mass power density, cycle life and fast charging capacity. At present, new types of lead-acid batteries researched and developed in the industry include bipolar lead-acid batteries and bipolar lug wound batteries with new structures, ceramic diaphragm batteries with new materials, foam graphite lead-acid batteries and lead carbon batteries. The research and development of new lead-acid batteries requires continuous R&D investment and relevant technology accumulation. Only enterprises with strong technical strength have the advantage to research and develop relevant technologies and enter relevant fields.

Environmental protection and financial barriers: According to the regulations and requirements of the Industry Specifications for Lead Batteries (2015 edition) issued by the Ministry of Industry and Information Technology, the production capacity of industrial enterprises in the same plant area should meet the minimum requirements. More advanced processes and automated production equipment in the industry should be used to improve efficiency and reduce environmental pollution. At the same time, relevant requirements for environmental protection, occupational health and safe production should also be met. The requirements of the above normative conditions will greatly increase the fixed asset investment and operating costs of industrial enterprises. Enterprises with weak financial strength are difficult to meet the requirements of the normative conditions and face the management of relevant government departments in terms of production license renewal, credit financing, environmental protection verification, etc.

Market barrier: The consideration of middle and high-end customers on the quality and consistency of lead-acid battery products makes the reputation, test results and quality performance of the manufacturer's products more valued, so the market reputation and quality performance have a greater impact on the sales of the manufacturer. Although battery products are consumables, the service life of some batteries can reach as long as 20 years, so it takes a long time to establish market reputation, and it is difficult for new entrants to reach the level of mature manufacturers in the industry in terms of reputation and reputation in the short term.

SWOT analysis of lead-acid battery industry

Advantages of lead-acid battery: low price, mature technology, excellent high and low temperature performance, stability and reliability, high security, good resource reuse (lead recycling rate is up to 98%), and obvious market competitive advantage. Compared with other battery metal materials, lead resources are relatively rich. The lead reserves and recycled lead will ensure the sustainable development of the lead-acid battery industry for a relatively long time. The lead-acid battery will be widely used, which will not cause a shortage of lead resources for a long time.

Disadvantages of lead-acid battery: the energy density is low, the cycle life is short, the main raw material lead is a class of toxic substances, there is a risk of lead pollution in the battery production and the process of recycling lead, and poor management may cause harm to the environment and human health.

Opportunities for lead-acid batteries: First, the battery industry has a good development prospect. Lead acid battery has become an indispensable basic product in the national economy due to its high safety performance, high cost performance, stable and reliable quality, and unique renewable recycling. With the progress of the industry's own technical level, as well as the development of the external economy and the improvement of the scientific and technological level, the industry has a good prospect for development. Lead acid batteries have a wide range of applications. At present, they are mainly used in: backup power batteries for communication, electric power, automatic control, emergency equipment, energy storage batteries for new energy sources such as wind energy and solar energy, starting and lighting of automobiles, motorcycles, fuel engines, and power batteries for electric bicycles, low-speed electric vehicles, and special electric vehicles. Second, the support of national industrial policies.

Third, the strict implementation of industrial norms and other policies is conducive to the concentration and upgrading of the lead-acid battery industry. Since the implementation of the industrial product production license system in the lead-acid battery industry in 2003, China has introduced a series of environmental protection policies and standards for the manufacture and recovery of lead-acid battery industry, such as the Notice on Deeply Carrying out the Special Action to Promote the Health and Environmental Protection of the People in Pollution Discharge Enterprises in 2011 (HF [2011] No. 4) Notice on Strengthening Pollution Prevention and Control of Lead Acid Battery and Regenerated Lead Industry (HF [2011] No. 56), Access Conditions for Lead Acid Battery Industry (Ministry of Industry and Information Technology and Ministry of Environmental Protection Announcement [2012 No. 18]), etc. and eliminated a batch of backward production capacity of lead acid battery industry. In 2015, the Ministry of Industry and Information Technology issued and implemented the Industrial Standard Conditions for Lead Battery, which is a replacement and upgrade of the Industrial Access Conditions for Lead Battery. The implementation of this policy will help improve the technological level and environmental protection management level of enterprises, reduce environmental pollution, enhance the concentration of China's lead acid battery industry, promote the sustainable and healthy development of China's lead acid battery industry, promote the industry reshuffle, and facilitate the sustainable and rapid development of high-quality enterprises in the industry. Fourth, the recycling technology of raw materials of waste lead-acid batteries is mature and highly marketable.

Risk of lead-acid battery: First, lack of technological innovation capability and environment. Although lead-acid batteries still occupy the main market share in the field of secondary batteries, in recent years, due to the argument that other new material batteries are about to replace lead-acid batteries, some of the industry's advantageous funds and scientific research strength have been transferred, which to some extent limits the development of lead-acid battery technology innovation. In addition, the 4% consumption tax levied on the lead-acid battery industry since 2016 has further reduced the willingness and ability of industrial enterprises to invest in technological innovation. Second, the competitive pressure of large international enterprises. Compared with the international large-scale industrial manufacturers, China's lead-acid battery industry is still small in scale, with weak R&D technology, financial strength and brand influence. Third, the development of the industry is under great pressure from public opinion. The production process of lead-acid batteries uses a large amount of heavy metal lead. If the pollutant emissions cannot be effectively controlled, it will cause adverse effects on the environment. The development of lead-acid batteries is facing greater public pressure. In fact, lead-acid battery is the battery with the best recycling and highest recovery rate. As long as the lead-acid battery industry is well managed, its pollution can be effectively controlled.

Analysis on Porter's Five Forces Model (Competition Pattern) of Lead Acid Battery Industry

The bargaining power of suppliers: the upstream of the lead-acid battery industry includes lead, sulfuric acid, plastic, etc. The lead-acid battery industry has a large demand for raw materials, the lead and sulfuric acid industries as a whole show overcapacity, and battery manufacturing is an important downstream application field of lead, so the lead-acid battery industry has a strong bargaining power for lead and sulfuric acid, while the supply of plastic falls short of demand, and the industry has high requirements for the characteristics of plastic, As a result, the bargaining power of the plastic industry is low.

Buyers' bargaining power: The downstream industries of lead-acid batteries are mainly automobiles, electric vehicles, communications, new energy, etc. Through comprehensive analysis, the bargaining power of the lead-acid battery industry is generally low, but the bargaining power of a few enterprises producing high-end lead-acid battery products is relatively high.

Threats from new entrants: During 2007-2010, the rapid development of the battery market and investment expansion made the domestic market highly differentiated, which led the Chinese government to adopt stricter requirements for the production facilities of lead-acid batteries, including a series of strict access conditions for new market entrants, such as safety, environmental protection commitments and minimum ideal capacity. As lead-acid battery enterprises largely rely on advanced product formula and high-yield operation, small market participants are easily eliminated in the market competition due to their low technical level and no cost advantage. For new market participants, it usually takes a long time to establish a good reputation and distribution network. As batteries are key components for electric bicycle manufacturers, and their battery quality and after-sales service are also important factors affecting the sales of electric bicycles, the downstream industrial system is very cautious in selecting appropriate lead-acid battery suppliers, and it is difficult for new market participants to become lead-acid battery suppliers in the downstream industry in a short time.

In recent years, China's lead-acid battery industry has enjoyed good profitability and kept a high level of profit margin with the pull of downstream demand, which has a strong attraction for potential entrants. However, the country has specially issued a series of standardized industry related policies, which has raised the threshold for the industry to enter. At the same time, the counterattack of existing enterprises has provided a large barrier for potential entrants. Therefore, the potential entrants of lead-acid batteries in China pose a general threat.

Threat of substitutes: At present, the main rechargeable batteries in the market are nickel hydrogen batteries, lead batteries and lithium ion batteries, among which lithium ion batteries are highly competitive to lead acid batteries. In the attribute comparison between lithium battery and lead-acid battery, two different types of batteries have their own advantages. The biggest advantage of lead-acid battery is its wide temperature band. The discharge function is good in low temperature environment, the body will not explode in high temperature environment, and the safety performance is high. Another big advantage is its low price, which is due to its rich raw materials and high resource recycling rate. On the other hand, lithium battery has the advantage of high battery energy density, which can open the market for new energy vehicles that require high endurance. In addition, relevant national policies also support the development of lithium ion batteries.

Lead acid battery suffers from the impact of lithium battery substitution, but the short-term impact is still limited. The types of lead-acid batteries include energy storage type, standby type, starting type and power type. At present, the lithium ion battery mainly replaces the lead-acid battery in the power type electric bicycle market. In recent years, the output of lithium electric bicycle has grown rapidly, but the market share is still far less than that of lead-acid electric bicycle. Compared with lead-acid batteries, lithium batteries do have the advantages of large energy density, small size, light weight, and large instantaneous discharge. However, when used on electric two wheel three wheel and four wheel vehicles, there are still fatal weaknesses in the current development:

First, the repair cycle of lithium-ion power batteries is long, and after-sales service cannot be promoted as widely as that of lead-acid batteries. When any battery in the battery pack has a problem during the repair of lithium-ion batteries, it must be transported to the factory for replacement through professional equipment and paired batteries. This process not only takes a long time, costs high, but also requires strict technology, which seriously restricts the large-scale introduction of lithium-ion batteries to the electric two wheeled vehicle industry.

Second, the use conditions are harsh, and the management system requirements are very high, which cannot be as durable as lead-acid batteries.

Third, the replacement price is surprisingly high, which cannot be as cheap as lead-acid batteries: now the price of lithium batteries has dropped significantly, more than 0.6 yuan/Wh for lead-acid batteries, and about 1 yuan/Wh for lithium batteries. However, as the majority of electric two wheeled vehicle consumers, they are quite sensitive to the price of battery replacement. It only costs 300-400 yuan to replace the old lead-acid battery with a new one. However, it is uncertain that the cost of replacing a set of lithium batteries (48v10Ah) in a lithium battery electric vehicle will not exceed 800 yuan (retail). On the contrary, the cost of purchasing a new lead-acid battery electric vehicle will only be about 2000 yuan (simple or small car). Such price gap makes it difficult to increase the consumer group of lithium trams. Up to now, lithium battery has been popularized in electric two wheeled vehicles for 8 years, and the replacement of lead-acid battery has not exceeded 10% up to now.

Moreover, the current development of new energy vehicles in China is driven by the strong support of policies. With the gradual decline of subsidies, the advantages of lithium batteries will not be so great. On the contrary, after so many years of market refining, the lead-acid battery industry chain has been very complete and sound. If lithium batteries want to shake the lead-acid battery industry in the harsh market competition, I'm afraid it can't be done in a short time, unless the promotion of lithium batteries on electric two wheel three wheel and four wheel vehicles also enjoys the same policy subsidies as new energy vehicles, but this is impossible!

To sum up, due to the characteristics of high endurance demand, lithium batteries will shine brightly in the application field of new energy vehicles. The development of new energy vehicles in the future and the guidance of national policies will certainly promote the development of lithium battery industry. However, the high cost of lithium battery in the production and recycling process cannot be ignored. The low cost brought by the high safety of lead-acid storage and the high resource recycling characteristics are also favored by manufacturers. Therefore, for a long time in the future, before the breakthrough of lithium battery recycling technology, lead-acid batteries will remain stable in the secondary power supply market.

Competition among industry competitors: In recent ten years, the growth of demand for automobiles, communications, electric bicycles and new energy storage has promoted the lead acid battery industry in China to maintain a relatively stable growth. With the acceleration of China's market economy, China's lead-acid battery enterprises have formed a variety of economic components, such as private, foreign capital, Sino foreign joint ventures, and state-owned enterprises

Lithium ForkLift Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium forklift batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

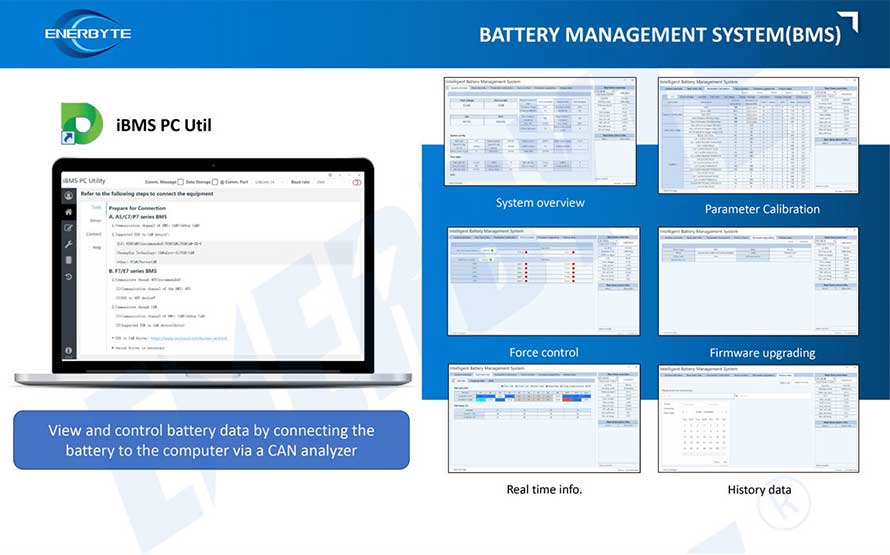

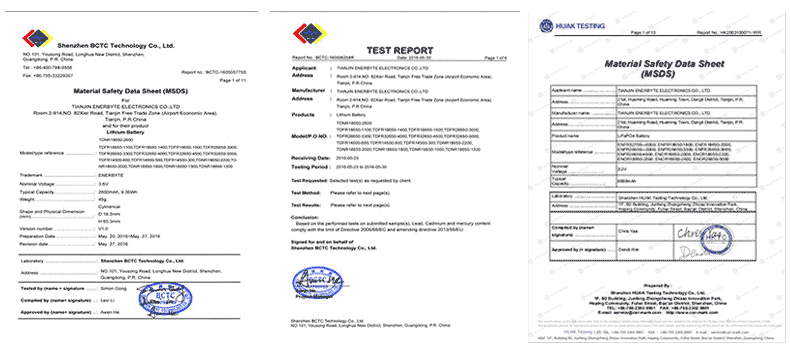

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

| Linde Lithium Forklift Battery | Toyota Lithium Forklift Battery | hyster Lithium Forklift Battery |

| jung Lithium Forklift Battery | enrich Lithium Forklift Battery | hyundai Lithium Forklift Battery |

| still Lithium Forklift Battery | heli Lithium Forklift Battery | hangcha Lithium Forklift Battery |

Service hotline

Service hotline