24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , lithium forklift battery manufacturer

Don't use the outdated valuation method of PE to look at CATL. By 2030, there will be ExxonMobil and Saudi Aramco, "said an analyst in response to the high valuation of the new energy industry chain and the difficulty of breaking up.

As Europe and the United States begin to emphasize "green recovery", China has made a commitment to "carbon neutrality", marking the beginning of the era of electric vehicles or smart cars. In the middle reaches of the new energy vehicle industry chain (batteries, separators, etc.), CATL, as a global leader in lithium battery research and development and manufacturing, has undoubtedly become the focus of domestic and foreign investment institutions. MSCI has given it an A-level ESG rating, which has also attracted foreign institutions that pay attention to ESG to continue buying, However, the high valuation has also led to a particularly sharp divergence in the industry's views on it. On January 8, 2021, CATL, which had only been established for about 10 years, had a market value of over 1 trillion yuan in the early trading of that day. However, recently, due to the tightening of liquidity margin, the "killing valuation" market has led to a continuous correction in the stock price. As of the close on February 5th, CATL was trading at 373.45 yuan, a nearly 12% pullback from its historical high of 424.99 yuan. The total market value fell back to 870 billion yuan, and the dynamic P/E ratio remained as high as 194.36 times.

To this day, the debate about whether CATL is worth trillions in market value is still ongoing. This questioning is not aimed at the strength or potential of the company, and the future will undoubtedly be the era of electric vehicles. However, in the context of the marginal shift in liquidity in the past two weeks, various sectors are starting to worry about whether this overestimation can be maintained. In response, First Financial reporters also interviewed senior investment managers and senior automotive industry analysts from multiple Chinese and foreign institutions.

Lithium ForkLift Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium forklift batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

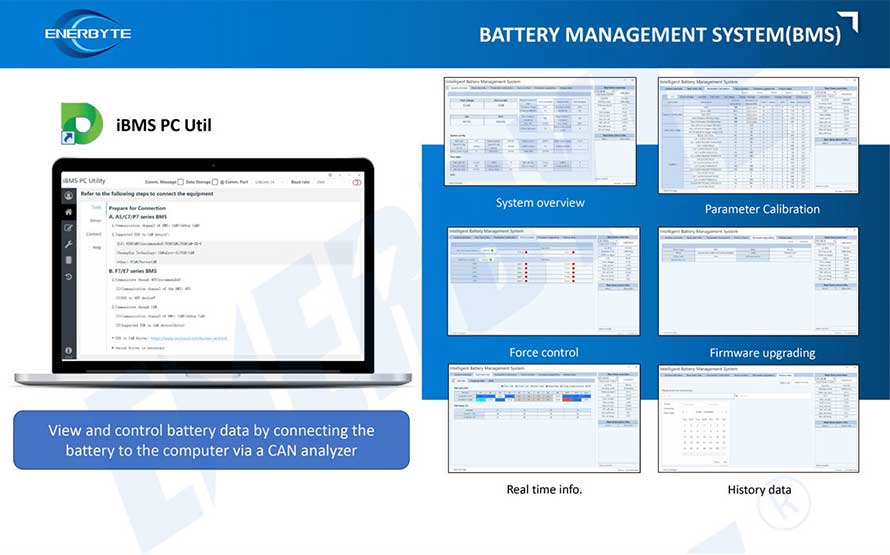

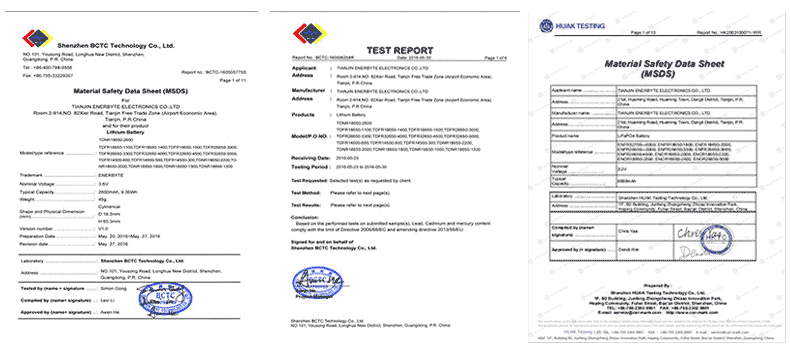

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

| Linde Lithium Forklift Battery | Toyota Lithium Forklift Battery | hyster Lithium Forklift Battery |

| jung Lithium Forklift Battery | enrich Lithium Forklift Battery | hyundai Lithium Forklift Battery |

| still Lithium Forklift Battery | heli Lithium Forklift Battery | hangcha Lithium Forklift Battery |

Service hotline

Service hotline