24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , lithium forklift battery manufacturer

In 2023, China's production of iron phosphate reached 1.16 million tons, an increase of 56% compared to 2022, with an expected growth rate of 23% in 2024. The market's expectations for iron phosphate in 2023 are too high, with production capacity growth far exceeding demand growth by 152%. Production capacity has increased from 1.48 million tons at the end of 2022 to 3.73 million tons at the end of 2023. In 2023, the production capacity of iron phosphate increased by 152%, far exceeding the production growth rate of 56%, while the demand growth rate was lower than expected. From 2022 to 2023, a large number of enterprises have flooded into the iron phosphate track, such as phosphorus resource enterprises Yuntianhua, Guizhou Phosphate, Chuanheng (Hengxuan), Yuntu, Yunxiang, Shengwei, Xingfa, and Chuanfa Longmang, titanium dioxide enterprises with ferrous sulfate resources such as Longbai Group and CNNC Titanium White, and other related new energy enterprises such as Zhongwei.

In 2023, there were several major phenomena throughout the year: firstly, the competition in the market was much more intense than expected; secondly, the alliance with major customers was vulnerable in the face of interests; and thirdly, the contractual spirit of locking prices and quantities disappeared almost completely. This is the beautiful trap of the iron phosphate industry: the entry threshold seems low but actually high, and a large number of new entrants keep paying tuition fees; The situation of "high profit and easy to make money" and "one year returns to the original and two years profits" in the supplier market is gone forever; The future is full of expectations, and we also need to wave our hands to call for new enterprises to join

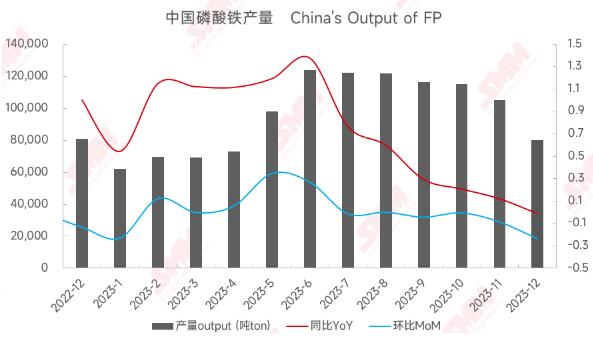

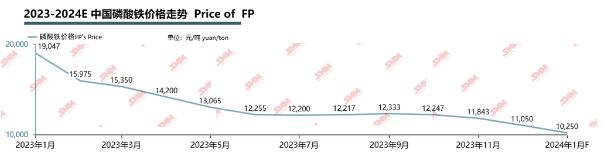

1、 Annual production and price situation: The annual production growth rate is 56%, which is lower than expected; The price has declined and the loss model has begun.

Changes in monthly production of iron phosphate in China in 2023

Changes in the price of iron phosphate in China in 2023

In the first half of 2023, with the gradual release of new production capacity by the end of 2022, the supply of iron phosphate increased. Lithium iron phosphate has high requirements for the performance and stability of iron phosphate, and the validation of iron phosphate precursors on lithium iron phosphate products takes about 6 months. In order to quickly introduce downstream customers into the product system, iron phosphate enterprises that have newly launched production capacity use low prices as preferential conditions to supply downstream lithium iron phosphate enterprises for product validation. At the same time, old power enterprises have also been forced to lower prices to maintain market share, and the price of iron phosphate has been continuously decreasing, narrowing the profits of iron phosphate enterprises.

In the second half of 2023, as we enter July, the prices of raw materials such as phosphorus, iron, and auxiliary materials for the production of iron phosphate have gradually increased, leading to an increase in the production cost of iron phosphate. However, due to overcapacity and imbalanced supply and demand structure, it is difficult to transmit costs downstream, and the profits of iron phosphate enterprises have begun to shift from positive to negative. The situation of oversupply in the fourth quarter is difficult to improve in the short term; Due to weak terminal demand, production of lithium iron phosphate enterprises has decreased, and the price of iron phosphate has been suppressed. Production costs remained stable and declined in the fourth quarter, but the decline in sales prices was faster, resulting in severe losses for the entire industry and intensified industry reshuffle.

Q1 2024: Demand weakened in the first quarter, and outsourcing iron phosphate enterprises engaged in price games on a few orders. Enterprises with new production capacity tend to accept orders at lower prices, paving the way for subsequent capacity release. Although many companies have a strong willingness to raise prices at the 10000 yuan mark, prices still showed a downward trend in January. Throughout 2024, iron phosphate enterprises will find ways to reduce costs, improve product yield, and maintain a fast iteration of product performance. Integrated enterprises may choose the strategy of outsourcing raw materials when prices decline.

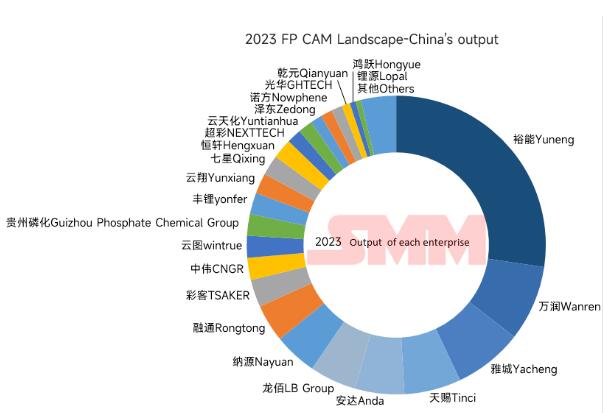

2、 Competitive landscape: Production is concentrated among top enterprises. Top companies occupy a large market share, and their market share varies greatly.

China's iron phosphate production in 2023- by enterprise

Integrated (self production and self use) leading enterprises: Yuneng, Wanrun, Rongtong, Anda, and so on. The top selling enterprises include Yacheng, Tianci, Nayuan, Caike, Longbai, Zhongwei, Yuntu, Phosphating, Fengli, Yunxiang, and many others.

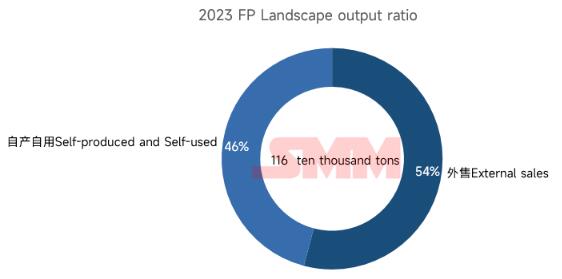

Integration (self production and self use) and proportion of external sales

46% of the enterprises are engaged in self production and self use, and some of these enterprises may outsource their products, but they hardly sell them; And the proportion of external sales enterprises (including Chaocai, which was acquired by Rongtong, and joint ventures with other iron and lithium enterprises) is 54%. In 2024, with the intensification of competition and the low price of iron phosphate, the proportion of external sales may increase.

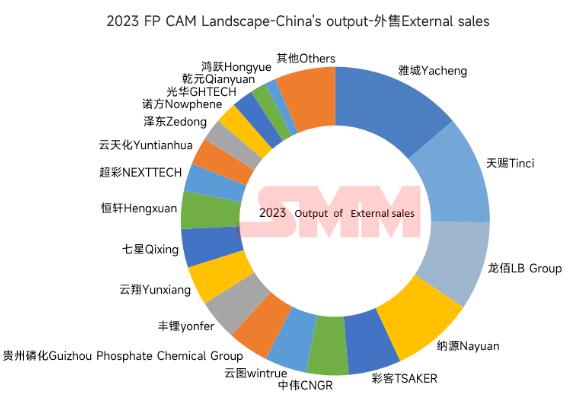

Production situation of outsourcing enterprises

Old established enterprises such as Yacheng and Tianci will not give up to the top two, while the emerging force Longbai Group will squeeze into the top three. Yacheng and Tianci use ammonium process technology, while Longbai uses sodium process technology. Nayuan and Caike followed closely behind, respectively, with sodium process and iron process. CR5 accounts for 50% and CR10 accounts for 70%. As competition intensifies, low capacity, resource free, and high cost enterprises face difficulties in survival, and their market share may decline.

Overall, the iron phosphate market is influenced by the iron lithium market, which refers to the market share of iron phosphate technology in the iron lithium market. At the same time, the sale of iron phosphate iron is also influenced by integrated iron lithium enterprises. Under two constraints, enterprises selling iron phosphate will face greater challenges than other enterprises.

Lithium ForkLift Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium forklift batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

| Linde Lithium Forklift Battery | Toyota Lithium Forklift Battery | hyster Lithium Forklift Battery |

| jung Lithium Forklift Battery | enrich Lithium Forklift Battery | hyundai Lithium Forklift Battery |

| still Lithium Forklift Battery | heli Lithium Forklift Battery | hangcha Lithium Forklift Battery |

Service hotline

Service hotline