24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , lithium forklift battery manufacturer

Cobalt industry chain

According to the statistics of the United States Geological Survey, the world's proven cobalt resource reserves are 7 million tons, including 3.4 million tons in Congo (DRC), accounting for 49%; Australia and Cuba are also major cobalt resource countries, accounting for 70% of the total.

China's cobalt reserves are only 80000 tons, accounting for 1.1%. Therefore, domestic companies usually transport cobalt concentrates and crude cobalt hydroxide back to China for smelting and processing. The main companies are Huayou Cobalt Industry, Greenmei and Jinchuan Group.

The cobalt industry chain includes exploration, mining and beneficiation, rough smelting processing, refining and deep processing.

Downstream products include: cobalt powder, which is used in the field of cemented carbide; Electrolytic cobalt is used in the fields of superalloys, magnetic materials and catalysts; Cobalt salts and cobalt trioxide are used in 3C consumer batteries, cobalt sulfate is used in ternary power batteries for energy vehicles, and other applications are in ceramics, rubber and other fields.

MB is the core of the price system

Global electricity cobalt supply and demand (including investment hoarding) determines the MB price. Its rise and fall affect the raw material cost and pricing system of the whole industry. The MB price, the sharing ratio between mines and smelters (discount coefficient or fixed processing fee mechanism) jointly affect the profitability of mines and the raw material cost of smelters, thus affecting the refined cobalt price at the cost end, thereby affecting the profitability of smelters.

MB quotation mechanism - The pricing system of the cobalt industry is based on MB quotation, and the supply and demand of international electric cobalt spot determine the MB price.

The cobalt industry refers to the MB quotation to a certain extent for both raw material purchase and sales pricing. In particular, the MB quotation will affect the signing of the long single mine and smelter manager's order, so the rise and fall of MB price will affect the pricing system of the whole industry and the raw material cost of the whole industry to a certain extent.

The MB price only reflects the spot transaction of electric cobalt in the international market, including the bulk quotation of metal cobalt manufacturers that circulate to traders and traders sell to downstream metal cobalt. The quotation of domestic electric cobalt is not adopted, the long order quotation of foreign electric cobalt is not adopted, and the delivery price of cobalt salt is not adopted.

Formation of negotiation coefficient - the negotiation coefficient of raw ore or intermediate purchase is determined by the supply and demand of ore

Cobalt concentrate is obtained from hand grasped ore/high-grade ore mining and dressing, and crude cobalt hydroxide intermediate is obtained from the mining and dressing of mature mines and low-grade ores, and the preliminary processing and production. The intermediate circulation is conducted by traders. The supply and demand of ore determine the negotiation coefficient of raw ore or intermediate purchase. If the supply and demand trend is tense, the negotiation coefficient is relatively high, and increases with the rise of MB price.

Generally speaking, the discount coefficient of high-grade ore is 50% to 6%, cobalt concentrate is 7.5%, and low-grade ore is 20% to 4%. After being processed by crude cobalt smelter (the processing cost is about 50000/t), the discount coefficient of crude cobalt hydroxide produced is 8.2% to 8.5%.

Fixed processing fee may be formed within a certain range, but the MB price still affects the raw material cost of the whole industry

The raw material supply agreement is usually a price range corresponding to the MB cobalt price. Under the negotiation coefficient mechanism previously, different prices correspond to the negotiation coefficient.

However, recently, due to the tight supply of cobalt products, Glencore and other mining giants are in the stage of high-level control. They intend to break the existing MB discount model, propose a new long order pricing mechanism, and price the raw material purchase agreement price with a fixed processing fee model. This fixed price model can only earn processing fees for downstream smelting enterprises, and cannot share the price rise cake of cobalt metal, which is strongly opposed by refining cobalt enterprises, Glencore has only signed agreements with some smelters, and the processing fee is fixed at USD 3.55/lb.

Whether it is the previous coefficient mechanism or the fixed processing fee mechanism, the price of MB cobalt will increase the raw material cost of the whole industry.

Monopoly by giants, slow new supply

Monopoly of mining rights and circulation by cobalt giants

Most of the upstream cobalt resources exist in the form of copper cobalt, nickel cobalt and other associated minerals, accounting for 78% of the reserves and 85% of the output. A small part of the raw materials come from recycled materials.

Major large cobalt mines in the world are controlled by Glencore, Luoyang Molybdenum Industry, Eurasian Resources, Sherrit Mining, Norilsk Nickel and other giants. In recent years, Glencore and Luoyang Molybdenum Industry rank first and second in terms of output, accounting for 37% in 2017.

Cobalt ore is mainly concentrated in African copper belt, Australia, Canada and other countries and regions, while smelting capacity is concentrated in China, Finland, Belgium and other countries, which is bound to trigger more frequent trade flows of cobalt raw materials. However, the number of global core traders is relatively small and concentrated, which is easy to form a high degree of control over cobalt products with small market capacity.

Uncertainty of new supply of cobalt ore

Glencore's KCC has the risk of interruption or delayed launch of new capacity

In Glencore's 2018-2020 capacity guidance, the KCC project output is 11,000 tons, 34,000 tons and 31,000 tons respectively.

At present, Glencore is faced with the law that Jerkamen requires it to dissolve KCC, and the application of DanGertler for an asset freeze order. Glencore's supply is faced with the risk of interruption or delay of new capacity.

In addition, considering the capacity ramp up period and mine transportation time, the actual new increment brought by the new capacity will still be affected to some extent. From Glencore itself, the company has the ability to solve the above problems, but its expansion progress and output may be affected to some extent.

The supply chain of civilian mining is almost the competition of stock market

Civilian mining refers to the processing of raw ores (grades ranging from 2% to 8%) produced by manual cooperatives or small mechanized mines into crude intermediates (cobalt content of 20% to 40%) through trade circulation.

At present, a large number of domestic enterprises go to Congo to build crude cobalt smelters, cooperate with small mechanized mines or authorized manual cooperatives, and use civilian mining resources. However, due to poor local infrastructure, insufficient energy, gradual decline in grade, and increased technical difficulties, it is generally possible that the production is delayed or the output is less than expected.

In addition, civilian mining is almost a stock market, which may flow to the market through different enterprises, but the total amount will not increase too much.

The supply of regenerated cobalt is still small

At present, recycled cobalt mainly comes from the recovery of alloy scraps, waste batteries and defective products in the production process of battery batteries. In 2017, the global renewable cobalt giants mainly included Meimeike, Greenmei, Bangpu Group and Ganzhou Haopeng, with the output of 1500 tons, 4000 tons, 1200 tons and 300 tons respectively.

In the future, the largest increment of regenerated cobalt will mainly come from the power battery of new energy vehicles. The design life of mainstream power batteries is 8 years or 150000 km. According to the current use scenario, a large part of cars are used in the field of online car hailing, which has a strong use intensity for cars. The battery will be scrapped for about 3 years.

In addition, considering the upgrading of new energy vehicles and the defects in battery quality at the initial stage, the battery retirement cycle of private cars also needs at least 5 years.

Since 2015, China's new energy vehicles have witnessed explosive growth. The lithium iron phosphate battery with a large charge capacity does not contain cobalt. Our passenger cars and special vehicles are dominated by ternary batteries. The rapid growth began in 2016. From 2016 to 2017, the installed capacity of ternary batteries was 6.23kWh and 16GWh respectively, and the corresponding cobalt metal consumption was about 1500 tons and 3300 tons.

The cars using the ternary power battery are scrapped at the same time, at most the above cobalt amount. However, this assumption does not exist.

Therefore, before 2020, the renewable cobalt of new energy vehicle power battery can be ignored compared with the cobalt of new mines, but after 2020, the growth rate will be relatively large, which is an important variable.

The demand for cobalt in power batteries of new energy vehicles is growing rapidly

Batteries are the largest market for cobalt

From the perspective of global consumer market, the consumption demand of battery for cobalt accounts for more than 59%, followed by high-temperature alloy and cemented carbide, accounting for about 15% and 7% respectively. From the domestic market, the consumption is mainly batteries, accounting for 77.4%.

At present, the demand for cobalt in power batteries of new energy vehicles shows a rapid growth trend, and the growth in super alloys and other fields remains stable, about 10%.

Subsidies recede, energy density increases, and ternary power batteries benefit

(1) The energy density of new energy vehicle power battery will continue to increase

In 2017, the four ministries and commissions jointly released the Action Plan for Promoting the Development of the Automotive Power Battery Industry. By 2020, the specific energy of the new lithium ion power battery unit will exceed 300wh/kg; The specific energy of the system shall strive to reach 260wh/kg, the cost shall be reduced to less than 1 yuan/wh, and the operating environment shall reach - 30 ° C to 55 ° C, which can have 3C charging capacity.

By 2025, the new system power battery technology will have made breakthrough progress, and the specific energy of monomer will reach 500wh/kg.

At present, the improved energy density of lithium iron phosphate can reach 160Wh/kg; The energy density of lithium manganate is about 150Wh/kg;

In the nickel cobalt manganese ternary material NCM, with the increase of nickel content, the energy density also increases significantly. At present, the mainstream NCM in China is still the NCM523/622 system, which is rapidly switching to the NCM811 system, and the energy density can reach 210Wh/kg;

The energy density of nickel cobalt aluminum ternary material NCA is 220-280Wh/kg, and the energy density of NCA supplied by Panasonic to Tesla can reach 300Wh/kg, which is the goal pursued by domestic enterprises.

Therefore, under the current technical conditions, high nickel ternary is the main path of high energy density power battery. In addition, with the improvement of the endurance mileage, the charging capacity of a single vehicle will increase rapidly, and the installed capacity of the power battery will also benefit.

(2) Subsidies continue to decline, and the amount of subsidies is related to energy density

In February 2018, the Ministry of Finance released the 2018 New Energy Vehicle Promotion and Application Subsidy Scheme (New Deal), which stipulates that the maximum speed of a 30 minute pure electric passenger vehicle shall not be less than 100km/h, and the driving range under working condition shall not be less than 150km; The driving range of plug-in hybrid (including incremental) passenger cars shall not be less than 50km.

At the same time, the subsidy echelon has been subdivided to improve the requirements for energy density. The higher the energy density, the longer the endurance mileage, the more subsidy amount.

The mass energy density of the power battery system of a pure electric passenger vehicle shall not be less than 105Wh/kg. Vehicles with 105 (including) - 120Wh/kg shall be subsidized 0.6 times, 120 (including) - 140Wh/kg vehicles shall be subsidized 1 times, 140 (including) - 160Wh/kg vehicles shall be subsidized 1.1 times, and 160 Wh/kg and above vehicles shall be subsidized 1.2 times. On this basis, an adjustment coefficient is set to assist calculation according to the energy consumption level.

The monthly release of new models is normalized, and the proportion of ternary power battery is the highest

On August 2, 2018, the Ministry of Industry and Information Technology issued the eighth batch of Recommended Models Catalog, and the first to second batches in 2017 and the first to fourth batches in 2018 will be abolished. The fifth batch of catalog includes 1977 models, including 294 pure electric passenger vehicles, accounting for 14.86%.

The sixth batch of catalog includes 353 models of 112 enterprises, including 324 models of pure electric products from 109 enterprises, 24 models of plug-in hybrid products from 8 enterprises, and 5 models of fuel cell products from 4 enterprises.

The seventh batch of catalog includes 342 models of 110 enterprises, including 318 models of pure electric products from 105 enterprises, 16 models of plug-in hybrid products from 9 enterprises, and 8 models of fuel cell products from 6 enterprises.

The eighth batch of catalog includes 385 models of 111 enterprises, including 353 models of pure electric products from 107 enterprises, 13 models of plug-in hybrid products from 9 enterprises, and 19 models of fuel cell products from 9 enterprises.

In 2018, the proportion of passenger cars among the recommended models increased significantly, reaching 14.65%, which also laid the foundation for the growth of the passenger car market.

In the 5-8 batches of Recommended Models Catalogue published by the Ministry of Industry and Information Technology, the average penetration rate of ternary power batteries in the field of pure electric passenger vehicles is 75.6%, and that of pure electric special vehicles is 50.8%.

In the field of new energy passenger vehicles, the penetration rate of ternary batteries is expected to further increase

In 2017, the average penetration rate of ternary vehicles in pure electric passenger vehicles was 74.4%, and the average penetration rate of pure electric special vehicles was 65.8%.

From January to July 2018, the cumulative sales volume of pure electric passenger vehicles was 309000, and the installed capacity of batteries reached 9.30GWh, of which the ternary penetration rate steadily increased, with the average penetration rate reaching 86.6%, and the average installation rate of lithium iron phosphate was 13.1%;

As of July, the cumulative installed capacity of battery for pure electric special vehicles is 1.77GWh, the average penetration rate of ternary is 75.6%, and the average installed rate of lithium iron phosphate is 18.0%.

New energy vehicles are shifting from policy driven to market driven. The charging capacity of single vehicle is increasing rapidly, and the demand for power batteries is growing rapidly. In the field of power battery, NCM523/622 is mainly used domestically, while hybrid ternary and NCA are mainly used abroad. With the development of new energy vehicles, the R&D efforts and industrialization process of high nickel ternary materials continue to move forward, and ternary materials rapidly evolve to NCM811 and NCA.

In addition, due to the increase of energy density of cathode materials, the consumption of other materials can be reduced accordingly. After the technology of high-end cathode materials is mature and the output is expanded, the cost of high nickel power batteries will be significantly reduced.

In the next three years, the installed capacity of ternary power batteries at home and abroad will increase by more than 60%

The power batteries used by new energy vehicles in China mainly include lithium iron phosphate, ternary and lithium manganate. Lithium iron phosphate and lithium manganate are safer, with relatively low energy density, and are widely used in the field of new energy buses and special vehicles.

Ternary batteries with high energy density are used in the field of passenger cars and special vehicles. With the continuous improvement of battery energy density and range requirements, the permeability of ternary materials is also growing rapidly. 2016 was the first year of explosive growth of ternary power batteries in China. Due to the small historical base, the installed capacity was only 6.3GWh, and the market share was only 22.4%;

In 2017, the installed capacity was more than 16GWh, accounting for 43.95% of the total installed capacity of power batteries in the whole year. The market share has nearly doubled, and it has stood against the lithium iron phosphate route.

In 2018-2020, the growth rate of ternary power battery will exceed 60%. In 2018, ternary power battery will surpass lithium iron phosphate in terms of growth rate and total amount, and become the "first brother" of the industry worthy of the name.

From the perspective of the international market, overseas vehicle enterprises mainly focus on the field of passenger vehicles, mainly ternary power batteries. In 2017, 640,000 new energy passenger vehicles (including ordinary hybrid vehicles) were sold. It is estimated that by 2020, the production and sales of overseas new energy vehicles will be the same as that of national energy vehicles, reaching 2 million, and the growth rate of power batteries will be more than 60%.

Consumer electronics demand is weak and is expected to recover seasonally

Weak demand for consumer electronics may be the main reason for the reduction of cobalt prices. According to the data of China ICT Research Institute, in April, China's mobile phone shipments fell 16.7% year on year, significantly weaker than the same period last year.

Consumer electronics accounted for 40-50% of the upstream cobalt demand, and the obvious weakening of consumer electronics has an impact on the overall supply and demand.

The demand for consumer electronics is expected to show a seasonal recovery, with Q3 demand increasing month on month.

The data in the field of global consumer electronics in Q1 2018 is not ideal: from the perspective of terminal products, according to IDC data, in Q1 2018, global smartphone shipments fell 2.93% year on year, 17.15% month on month, global tablet shipments fell 11.45% year on year, 36.09% month on month, global PC shipments fell 0.02% year on year, 14.45% month on month.

This group of data and the CO3O4 orders learned from the industry chain research mutually confirm. However, it is worth noting that the shipment of consumer electronics has obvious seasonal characteristics. From the global historical data, Q3 is often the peak consumption season in the year. Therefore, we expect a seasonal recovery in the consumer electronics field, with an increase in demand month on month.

In addition, it should be noted that in the consumption field, the method of partially doping ternary cathode materials has been adopted to reduce the use of cobalt in batteries, which is the demand side reduction.

The inventory is basically digested, and long order purchase is expected to enter the site

The new energy vehicle power battery industry chain is undergoing a reshuffle, with structural changes intensifying, leading enterprises expanding, while other market participants' market shares are squeezed and their concentration is increasing.

In the change of industrial trend, we noticed that the installed capacity of power battery increased year on year and month on month, but the total amount of positive materials was stable month on month, which was largely caused by the battery manufacturers' de stocking.

In 2017, the industry experienced rapid growth and expansion, and the whole industry chain was relatively active in inventory and production scheduling. However, during the reshuffle, most enterprises faced two major problems: first, order compression; Second, due to the shortage of funds, we digested the battery and material inventory formed before, while maintaining a more cautious strategy for raw material procurement.

Therefore, in 2018H1, under the condition that the installed capacity of power battery increased year on year and month on month, the total amount of positive materials did not increase significantly, especially lithium iron phosphate positive materials, even continued to grow negatively.

According to the industrial chain survey, the positive material manufacturers in the middle reaches almost have no cobalt inventory, and adopt the mode of "signing orders first and signing cobalt purchase contracts at the same time" to avoid the risk of abnormal fluctuations in cobalt prices as much as possible. In the circulation link, there is not much inventory in the hands of traders, so there will be no selling phenomenon.

We believe that, with the increase of long endurance mileage and high energy density models, the charging capacity of single vehicle has increased on a year-on-year basis, which will rapidly drive the demand in the middle and upper reaches, especially when the inventory of raw materials and finished products in the industrial chain is low, the demand transmission sensitivity of the industrial chain is more intense, and the destocking stage or near the end will enter the replenishment stage.

The impact or margin of cobalt export is weakened, and the price of cobalt is expected to rise again

The price difference of cobalt at home and abroad has reached a large level, which is expected to narrow, and the impact of domestic exports is expected to weaken marginally. Since this year, due to the impact of the inventory cycle of the new energy automobile industry chain, superposing the slack season of consumer electronics demand, the cobalt salt price fell in April, which led to a correction in the domestic metal cobalt price. The difference between domestic and foreign metal cobalt prices widened, leading to the opening of the profitability of metal cobalt exports. Domestic exports hit the overseas metal cobalt market, resulting in a slightly delayed MB price correction, which occurred in early May.

From the perspective of historical domestic/export electrolytic cobalt profitability, the export profit window also appeared in the same period last year, that is, in May 2017, and the export volume expanded rapidly.

With the resonance between the domestic new energy automobile industry chain and consumer electronics, domestic prices are expected to stabilize, the cobalt sulfate discount and the price difference between domestic and overseas metal cobalt are expected to narrow, and the impact margin of domestic electrolytic cobalt exports on MB prices is weakened. Cobalt industry chain

According to the statistics of the United States Geological Survey, the world's proven cobalt resource reserves are 7 million tons, including 3.4 million tons in Congo (DRC), accounting for 49%; Australia and Cuba are also major cobalt resource countries, accounting for 70% of the total.

China's cobalt reserves are only 80000 tons, accounting for 1.1%. Therefore, domestic companies usually transport cobalt concentrates and crude cobalt hydroxide back to China for smelting and processing. The main companies are Huayou Cobalt Industry, Greenmei and Jinchuan Group.

The cobalt industry chain includes exploration, mining and beneficiation, rough smelting processing, refining and deep processing.

Downstream products include: cobalt powder, which is used in the field of cemented carbide; Electrolytic cobalt is used in the fields of superalloys, magnetic materials and catalysts; Cobalt salts and cobalt trioxide are used in 3C consumer batteries, cobalt sulfate is used in ternary power batteries for energy vehicles, and other applications are in ceramics, rubber and other fields.

MB is the core of the price system

Global electricity cobalt supply and demand (including investment hoarding) determines the MB price. Its rise and fall affect the raw material cost and pricing system of the whole industry. The MB price, the sharing ratio between mines and smelters (discount coefficient or fixed processing fee mechanism) jointly affect the profitability of mines and the raw material cost of smelters, thus affecting the refined cobalt price at the cost end, thereby affecting the profitability of smelters.

MB quotation mechanism - The pricing system of the cobalt industry is based on MB quotation, and the supply and demand of international electric cobalt spot determine the MB price.

The cobalt industry refers to the MB quotation to a certain extent for both raw material purchase and sales pricing. In particular, the MB quotation will affect the signing of the long single mine and smelter manager's order, so the rise and fall of MB price will affect the pricing system of the whole industry and the raw material cost of the whole industry to a certain extent.

The MB price only reflects the spot transaction of electric cobalt in the international market, including the bulk quotation of metal cobalt manufacturers that circulate to traders and traders sell to downstream metal cobalt. The quotation of domestic electric cobalt is not adopted, the long order quotation of foreign electric cobalt is not adopted, and the delivery price of cobalt salt is not adopted.

Formation of negotiation coefficient - the negotiation coefficient of raw ore or intermediate purchase is determined by the supply and demand of ore

Cobalt concentrate is obtained from hand grasped ore/high-grade ore mining and dressing, and crude cobalt hydroxide intermediate is obtained from the mining and dressing of mature mines and low-grade ores, and the preliminary processing and production. The intermediate circulation is conducted by traders. The supply and demand of ore determine the negotiation coefficient of raw ore or intermediate purchase. If the supply and demand trend is tense, the negotiation coefficient is relatively high, and increases with the rise of MB price.

Generally speaking, the discount coefficient of high-grade ore is 50% to 6%, cobalt concentrate is 7.5%, and low-grade ore is 20% to 4%. After being processed by crude cobalt smelter (the processing cost is about 50000/t), the discount coefficient of crude cobalt hydroxide produced is 8.2% to 8.5%.

Fixed processing fee may be formed within a certain range, but the MB price still affects the raw material cost of the whole industry

The raw material supply agreement is usually a price range corresponding to the MB cobalt price. Under the negotiation coefficient mechanism previously, different prices correspond to the negotiation coefficient.

However, recently, due to the tight supply of cobalt products, Glencore and other mining giants are in the stage of high-level control. They intend to break the existing MB discount model, propose a new long order pricing mechanism, and price the raw material purchase agreement price with a fixed processing fee model. This fixed price model can only earn processing fees for downstream smelting enterprises, and cannot share the price rise cake of cobalt metal, which is strongly opposed by refining cobalt enterprises, Glencore has only signed agreements with some smelters, and the processing fee is fixed at USD 3.55/lb.

Whether it is the previous coefficient mechanism or the fixed processing fee mechanism, the price of MB cobalt will increase the raw material cost of the whole industry.

Monopoly by giants, slow new supply

Monopoly of mining rights and circulation by cobalt giants

Most of the upstream cobalt resources exist in the form of copper cobalt, nickel cobalt and other associated minerals, accounting for 78% of the reserves and 85% of the output. A small part of the raw materials come from recycled materials.

Major large cobalt mines in the world are controlled by Glencore, Luoyang Molybdenum Industry, Eurasian Resources, Sherrit Mining, Norilsk Nickel and other giants. In recent years, Glencore and Luoyang Molybdenum Industry rank first and second in terms of output, accounting for 37% in 2017.

Cobalt ore is mainly concentrated in African copper belt, Australia, Canada and other countries and regions, while smelting capacity is concentrated in China, Finland, Belgium and other countries, which is bound to trigger more frequent trade flows of cobalt raw materials. However, the number of global core traders is relatively small and concentrated, which is easy to form a high degree of control over cobalt products with small market capacity.

Uncertainty of new supply of cobalt ore

Glencore's KCC has the risk of interruption or delayed launch of new capacity

In Glencore's 2018-2020 capacity guidance, the KCC project output is 11,000 tons, 34,000 tons and 31,000 tons respectively.

At present, Glencore is faced with the law that Jerkamen requires it to dissolve KCC, and the application of DanGertler for an asset freeze order. Glencore's supply is faced with the risk of interruption or delay of new capacity.

In addition, considering the capacity ramp up period and mine transportation time, the actual new increment brought by the new capacity will still be affected to some extent. From Glencore itself, the company has the ability to solve the above problems, but its expansion progress and output may be affected to some extent.

The supply chain of civilian mining is almost the competition of stock market

Civilian mining refers to the processing of raw ores (grades ranging from 2% to 8%) produced by manual cooperatives or small mechanized mines into crude intermediates (cobalt content of 20% to 40%) through trade circulation.

At present, a large number of domestic enterprises go to Congo to build crude cobalt smelters, cooperate with small mechanized mines or authorized manual cooperatives, and use civilian mining resources. However, due to poor local infrastructure, insufficient energy, gradual decline in grade, and increased technical difficulties, it is generally possible that the production is delayed or the output is less than expected.

In addition, civilian mining is almost a stock market, which may flow to the market through different enterprises, but the total amount will not increase too much.

The supply of regenerated cobalt is still small

At present, recycled cobalt mainly comes from the recovery of alloy scraps, waste batteries and defective products in the production process of battery batteries. In 2017, the global renewable cobalt giants mainly included Meimeike, Greenmei, Bangpu Group and Ganzhou Haopeng, with the output of 1500 tons, 4000 tons, 1200 tons and 300 tons respectively.

In the future, the largest increment of regenerated cobalt will mainly come from the power battery of new energy vehicles. The design life of mainstream power batteries is 8 years or 150000 km. According to the current use scenario, a large part of cars are used in the field of online car hailing, which has a strong use intensity for cars. The battery will be scrapped for about 3 years.

In addition, considering the upgrading of new energy vehicles and the defects in battery quality at the initial stage, the battery retirement cycle of private cars also needs at least 5 years.

Since 2015, China's new energy vehicles have witnessed explosive growth. The lithium iron phosphate battery with a large charge capacity does not contain cobalt. Our passenger cars and special vehicles are dominated by ternary batteries. The rapid growth began in 2016. From 2016 to 2017, the installed capacity of ternary batteries was 6.23kWh and 16GWh respectively, and the corresponding cobalt metal consumption was about 1500 tons and 3300 tons.

The cars using the ternary power battery are scrapped at the same time, at most the above cobalt amount. However, this assumption does not exist.

Therefore, before 2020, the renewable cobalt of new energy vehicle power battery can be ignored compared with the cobalt of new mines, but after 2020, the growth rate will be relatively large, which is an important variable.

The demand for cobalt in power batteries of new energy vehicles is growing rapidly

Batteries are the largest market for cobalt

From the perspective of global consumer market, the consumption demand of battery for cobalt accounts for more than 59%, followed by high-temperature alloy and cemented carbide, accounting for about 15% and 7% respectively. From the domestic market, the consumption is mainly batteries, accounting for 77.4%.

At present, the demand for cobalt in power batteries of new energy vehicles shows a rapid growth trend, and the growth in super alloys and other fields remains stable, about 10%.

Subsidies recede, energy density increases, and ternary power batteries benefit

(1) The energy density of new energy vehicle power battery will continue to increase

In 2017, the four ministries and commissions jointly released the Action Plan for Promoting the Development of the Automotive Power Battery Industry. By 2020, the specific energy of the new lithium ion power battery unit will exceed 300wh/kg; The specific energy of the system shall strive to reach 260wh/kg, the cost shall be reduced to less than 1 yuan/wh, and the operating environment shall reach - 30 ° C to 55 ° C, which can have 3C charging capacity.

By 2025, the new system power battery technology will have made breakthrough progress, and the specific energy of monomer will reach 500wh/kg.

At present, the improved energy density of lithium iron phosphate can reach 160Wh/kg; The energy density of lithium manganate is about 150Wh/kg;

In the nickel cobalt manganese ternary material NCM, with the increase of nickel content, the energy density also increases significantly. At present, the mainstream NCM in China is still the NCM523/622 system, which is rapidly switching to the NCM811 system, and the energy density can reach 210Wh/kg;

The energy density of nickel cobalt aluminum ternary material NCA is 220-280Wh/kg, and the energy density of NCA supplied by Panasonic to Tesla can reach 300Wh/kg, which is the goal pursued by domestic enterprises.

Therefore, under the current technical conditions, high nickel ternary is the main path of high energy density power battery. In addition, with the improvement of the endurance mileage, the charging capacity of a single vehicle will increase rapidly, and the installed capacity of the power battery will also benefit.

(2) Subsidies continue to decline, and the amount of subsidies is related to energy density

In February 2018, the Ministry of Finance released the 2018 New Energy Vehicle Promotion and Application Subsidy Scheme (New Deal), which stipulates that the maximum speed of a 30 minute pure electric passenger vehicle shall not be less than 100km/h, and the driving range under working condition shall not be less than 150km; The driving range of plug-in hybrid (including incremental) passenger cars shall not be less than 50km.

At the same time, the subsidy echelon has been subdivided to improve the requirements for energy density. The higher the energy density, the longer the endurance mileage, the more subsidy amount.

The mass energy density of the power battery system of a pure electric passenger vehicle shall not be less than 105Wh/kg. Vehicles with 105 (including) - 120Wh/kg shall be subsidized 0.6 times, 120 (including) - 140Wh/kg vehicles shall be subsidized 1 times, 140 (including) - 160Wh/kg vehicles shall be subsidized 1.1 times, and 160 Wh/kg and above vehicles shall be subsidized 1.2 times. On this basis, an adjustment coefficient is set to assist calculation according to the energy consumption level.

The monthly release of new models is normalized, and the proportion of ternary power battery is the highest

On August 2, 2018, the Ministry of Industry and Information Technology issued the eighth batch of Recommended Models Catalog, and the first to second batches in 2017 and the first to fourth batches in 2018 will be abolished. The fifth batch of catalog includes 1977 models, including 294 pure electric passenger vehicles, accounting for 14.86%.

The sixth batch of catalog includes 353 models of 112 enterprises, including 324 models of pure electric products from 109 enterprises, 24 models of plug-in hybrid products from 8 enterprises, and 5 models of fuel cell products from 4 enterprises.

The seventh batch of catalog includes 342 models of 110 enterprises, including 318 models of pure electric products from 105 enterprises, 16 models of plug-in hybrid products from 9 enterprises, and 8 models of fuel cell products from 6 enterprises.

The eighth batch of catalog includes 385 models of 111 enterprises, including 353 models of pure electric products from 107 enterprises, 13 models of plug-in hybrid products from 9 enterprises, and 19 models of fuel cell products from 9 enterprises.

In 2018, the proportion of passenger cars among the recommended models increased significantly, reaching 14.65%, which also laid the foundation for the growth of the passenger car market.

In the 5-8 batches of Recommended Models Catalogue published by the Ministry of Industry and Information Technology, the average penetration rate of ternary power batteries in the field of pure electric passenger vehicles is 75.6%, and that of pure electric special vehicles is 50.8%.

In the field of new energy passenger vehicles, the penetration rate of ternary batteries is expected to further increase

In 2017, the average penetration rate of ternary vehicles in pure electric passenger vehicles was 74.4%, and the average penetration rate of pure electric special vehicles was 65.8%.

From January to July 2018, the cumulative sales volume of pure electric passenger vehicles was 309000, and the installed capacity of batteries reached 9.30GWh, of which the ternary penetration rate steadily increased, with the average penetration rate reaching 86.6%, and the average installation rate of lithium iron phosphate was 13.1%;

As of July, the cumulative installed capacity of battery for pure electric special vehicles is 1.77GWh, the average penetration rate of ternary is 75.6%, and the average installed rate of lithium iron phosphate is 18.0%.

New energy vehicles are shifting from policy driven to market driven. The charging capacity of single vehicle is increasing rapidly, and the demand for power batteries is growing rapidly. In the field of power battery, NCM523/622 is mainly used domestically, while hybrid ternary and NCA are mainly used abroad. With the development of new energy vehicles, the R&D efforts and industrialization process of high nickel ternary materials continue to move forward, and ternary materials rapidly evolve to NCM811 and NCA.

In addition, due to the increase of energy density of cathode materials, the consumption of other materials can be reduced accordingly. After the technology of high-end cathode materials is mature and the output is expanded, the cost of high nickel power batteries will be significantly reduced.

In the next three years, the installed capacity of ternary power batteries at home and abroad will increase by more than 60%

The power batteries used by new energy vehicles in China mainly include lithium iron phosphate, ternary and lithium manganate. Lithium iron phosphate and lithium manganate are safer, with relatively low energy density, and are widely used in the field of new energy buses and special vehicles.

Ternary batteries with high energy density are used in the field of passenger cars and special vehicles. With the continuous improvement of battery energy density and range requirements, the permeability of ternary materials is also growing rapidly. 2016 was the first year of explosive growth of ternary power batteries in China. Due to the small historical base, the installed capacity was only 6.3GWh, and the market share was only 22.4%;

In 2017, the installed capacity was more than 16GWh, accounting for 43.95% of the total installed capacity of power batteries in the whole year. The market share has nearly doubled, and it has stood against the lithium iron phosphate route.

In 2018-2020, the growth rate of ternary power battery will exceed 60%. In 2018, ternary power battery will surpass lithium iron phosphate in terms of growth rate and total amount, and become the "first brother" of the industry worthy of the name.

From the perspective of the international market, overseas vehicle enterprises mainly focus on the field of passenger vehicles, mainly ternary power batteries. In 2017, 640,000 new energy passenger vehicles (including ordinary hybrid vehicles) were sold. It is estimated that by 2020, the production and sales of overseas new energy vehicles will be the same as that of national energy vehicles, reaching 2 million, and the growth rate of power batteries will be more than 60%.

Consumer electronics demand is weak and is expected to recover seasonally

Weak demand for consumer electronics may be the main reason for the reduction of cobalt prices. According to the data of China ICT Research Institute, in April, China's mobile phone shipments fell 16.7% year on year, significantly weaker than the same period last year.

Consumer electronics accounted for 40-50% of the upstream cobalt demand, and the obvious weakening of consumer electronics has an impact on the overall supply and demand.

The demand for consumer electronics is expected to show a seasonal recovery, with Q3 demand increasing month on month.

The data in the field of global consumer electronics in Q1 2018 is not ideal: from the perspective of terminal products, according to IDC data, in Q1 2018, global smartphone shipments fell 2.93% year on year, 17.15% month on month, global tablet shipments fell 11.45% year on year, 36.09% month on month, global PC shipments fell 0.02% year on year, 14.45% month on month.

This group of data and the CO3O4 orders learned from the industry chain research mutually confirm. However, it is worth noting that the shipment of consumer electronics has obvious seasonal characteristics. From the global historical data, Q3 is often the peak consumption season in the year. Therefore, we expect a seasonal recovery in the consumer electronics field, with an increase in demand month on month.

In addition, it should be noted that in the consumption field, the method of partially doping ternary cathode materials has been adopted to reduce the use of cobalt in batteries, which is the demand side reduction.

The inventory is basically digested, and long order purchase is expected to enter the site

The new energy vehicle power battery industry chain is undergoing a reshuffle, with structural changes intensifying, leading enterprises expanding, while other market participants' market shares are squeezed and their concentration is increasing.

In the change of industrial trend, we noticed that the installed capacity of power battery increased year on year and month on month, but the total amount of positive materials was stable month on month, which was largely caused by the battery manufacturers' de stocking.

In 2017, the industry experienced rapid growth and expansion, and the whole industry chain was relatively active in inventory and production scheduling. However, during the reshuffle, most enterprises faced two major problems: first, order compression; Second, due to the shortage of funds, we digested the battery and material inventory formed before, while maintaining a more cautious strategy for raw material procurement.

Therefore, in 2018H1, under the condition that the installed capacity of power battery increased year on year and month on month, the total amount of positive materials did not increase significantly, especially lithium iron phosphate positive materials, even continued to grow negatively.

According to the industrial chain survey, the positive material manufacturers in the middle reaches almost have no cobalt inventory, and adopt the mode of "signing orders first and signing cobalt purchase contracts at the same time" to avoid the risk of abnormal fluctuations in cobalt prices as much as possible. In the circulation link, there is not much inventory in the hands of traders, so there will be no selling phenomenon.

We believe that, with the increase of long endurance mileage and high energy density models, the charging capacity of single vehicle has increased on a year-on-year basis, which will rapidly drive the demand in the middle and upper reaches, especially when the inventory of raw materials and finished products in the industrial chain is low, the demand transmission sensitivity of the industrial chain is more intense, and the destocking stage or near the end will enter the replenishment stage.

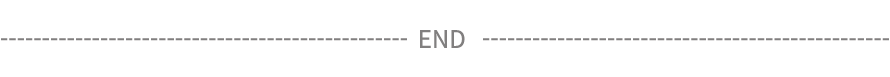

Lithium ForkLift Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium forklift batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

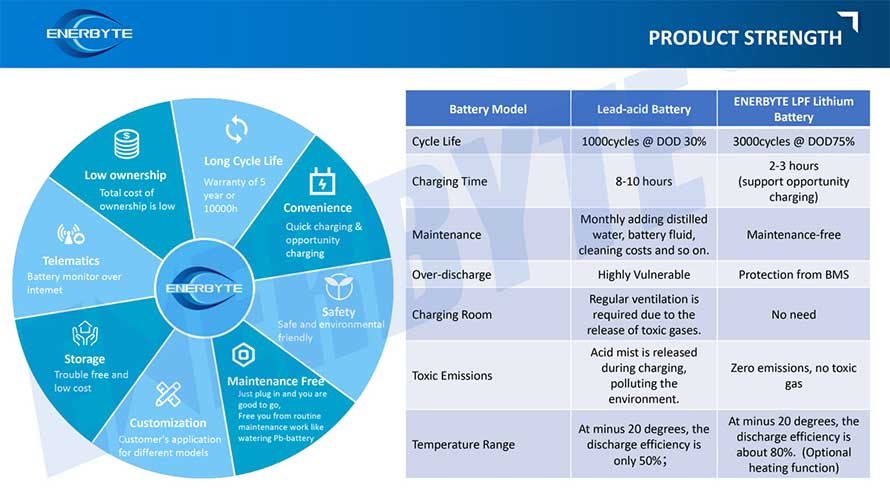

We have a comprehensive explanation of lithium batteries

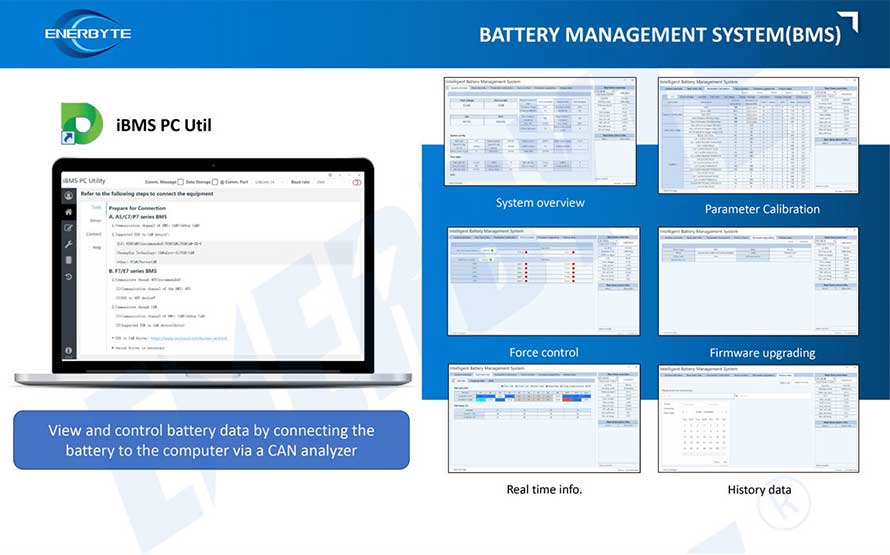

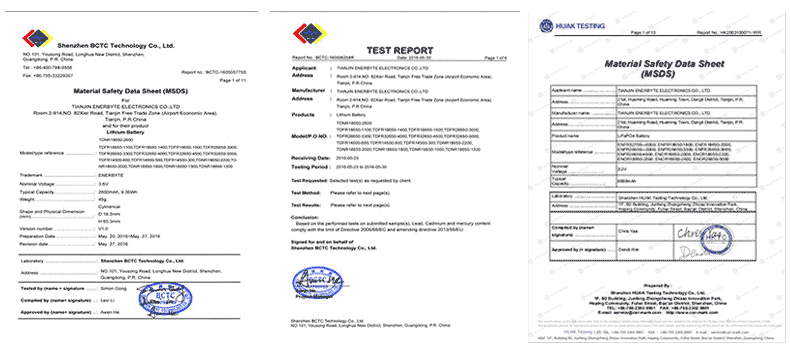

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

| Linde Lithium Forklift Battery | Toyota Lithium Forklift Battery | hyster Lithium Forklift Battery |

| jung Lithium Forklift Battery | enrich Lithium Forklift Battery | hyundai Lithium Forklift Battery |

| still Lithium Forklift Battery | heli Lithium Forklift Battery | hangcha Lithium Forklift Battery |

Service hotline

Service hotline