24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , lithium forklift battery manufacturer

Speaking of power lithium battery, many practitioners are familiar with it. As the third largest field of lithium battery after consumer electronics and energy storage equipment, it has gradually become one of the core competitiveness of new energy vehicles. Consumers have put forward higher requirements on the safety, endurance and cost of power lithium battery. As the core component of new energy vehicles, the competition in the power lithium battery market has never stopped, and even intensified.

1、 Basic introduction of power lithium battery

The power lithium battery is a product with certain differences, and the different functional requirements of the automobile have a decisive impact on the battery parameters. Roughly speaking, lithium batteries can be divided into two types according to their usage. One is power type, which is mainly used to provide short-term power for vehicle acceleration. It can store less energy and cannot supply energy for a long time. Its energy release time usually lasts from a few seconds to dozens of minutes; The other type is energy type, which can supply energy for a long time, but the discharge rate is relatively small. Generally, the discharge time is designed to be 1 hour or even longer. Generally, pure electric vehicles will use energy type batteries.

The important difference between power type battery and energy type battery is the power/energy ratio, that is, the discharge rate. The discharge rate of power type battery can reach more than 15C, and the discharge rate of energy type battery can not exceed 2C. With the increasing charge of pure electric vehicle, the requirements on discharge rate will be further relaxed. The two demands are reflected at the core level. The most significant difference is that the active layer is thin, the energy density is low and the cost is higher to ensure structural stability due to the large current density of the power type core electrode. Therefore, the design of these two types of cells in industry is quite different. During the design of power lithium battery, it is necessary to understand the battery performance indicators and battery service conditions of electrical equipment, and generally consider the following aspects: battery working voltage; Battery working time; Battery working environment; Maximum allowable volume of battery.

Argonne National Laboratory proposed a set of design principles, which require users to input multiple design parameters, such as battery power, number of batteries and modules, and target voltage at maximum power. In addition, the user must enter one of the following three energy measurements: battery pack energy, battery capacity or vehicle electrical range, meaning that one value will determine the other two values. Then, the iterative process solves the user defined energy parameters (energy, capacity or range) and residual battery characteristics by changing the battery capacity and electrode thickness. The result is the size, mass, volume and material requirements of batteries, modules and battery packs.

Flow chart of lithium battery parameter design:

Production flow chart of lithium battery:

2、 Market segment analysis of power lithium battery

The power lithium battery is the heart of new energy electric vehicles. As a key component of electric vehicles, the power lithium battery is the largest component in the vehicle cost, accounting for 30% - 40% of the vehicle cost. It is an emerging industry with a potential market of hundreds of billions. The competition for the core technology and supply chain of power lithium battery will become another commanding point in the competition of manufacturing industry in large countries, and will largely affect the future global new energy vehicle industry pattern. The cost of four key materials subdivided into positive material, negative material, diaphragm and electrolyte accounts for more than 80% of the battery cost.

1. Cathode material: In 2019, the output will exceed 500000 tons, and competitive companies will occupy important market shares

The output of lithium battery cathode materials in China has risen rapidly, which is mainly due to the rapid development of mobile phones, laptops, electric vehicles, etc. in the downstream industry of lithium batteries, the company's increased investment in lithium battery cathode materials, the development of new energy vehicles, and the support of national policies. According to the investigation of the Lithium Branch of China Nonferrous Metals Industry Association, the output of lithium battery cathode materials in China will exceed 500000 tons in 2019, reaching 537000 tons.

(Note: the growth rate of output in 2016 and 2017 was 49.6% and 99.9% respectively)

In the domestic market, there are still many companies participating in the market competition. Due to the high degree of technology integration in the lithium battery cathode material industry and the strict requirements of downstream customers on product quality, some companies without core competitiveness will gradually withdraw, and the dominant companies in the industry will occupy more and more market shares. In recent years, the market of lithium battery cathode materials in China has developed rapidly, and the production and sales of cathode materials have accounted for more than 40% of the world. The output of major domestic cathode material companies is as follows:

2. Negative electrode material: the output will be about 250000 tons in 2019, and the competition pattern of industry companies will not change much

In recent years, the output of negative electrode materials in China has shown a trend of increasing year by year. In 2019, the output of negative electrode materials in China will be about 250000 tons, and the market share of artificial graphite is estimated to be more than 75%. Its market share has further expanded. The demand for needle coke is expected to remain strong this year.

(Note: the output growth rate in 2016 and 2018 was 33.6% and 47.7% respectively)

From the perspective of the company's competition pattern, in 2019, Shenzhen Betray, Jiangxi Zichen and Shanshan Technology occupy the top three positions, but the market share gap between the three is gradually narrowing. Second tier manufacturers, such as Hunan Zhongke, Shenzhen Snow, and Shenzhen Xiangfeng, have maintained rapid growth driven by power lithium batteries. According to the competitiveness ranking list of lithium battery cathode material companies published by China Battery Network, the competition pattern of industry companies has not changed much.

3. Diaphragm: high-end diaphragms are basically imported, and Enjie shares rank first in the counter attack

Due to the high technical barriers of diaphragms, there is a large gap between the performance of domestic diaphragms and that of imported diaphragms, leading to the majority of domestic diaphragm markets to be imported, especially high-end diaphragms. According to the statistics of Start Point Research Institute (SPIR), in the first half of 2019, China's lithium battery diaphragm shipment volume was 1.38 billion square meters, up 70% year on year. The main reasons are: the diaphragm export volume has increased significantly, and the important companies are: Enjie, Xingyuan, Jieli, etc; Energy storage, 3C digital and small power drive market demand, coupled with the steady rise of power lithium batteries; The subsidy transition period was cancelled when the policy was introduced, so the first two months of the second quarter were the peak period of industry impulse.

In the 2019 annual brand list of China's lithium battery diaphragm industry, Enjie's counter attack ranked first, and its customers covered domestic first-line battery companies. The counter attack of Enjie's shares can fully prove that the industry leader can be defeated. A few years ago, the domestic diaphragm industry was monopolized by three companies, namely StarSource Materials, Jinhui High Tech and Zhongke Technology. Now, there is no doubt that ENJE has become the leading company in the diaphragm industry at home, especially in the wet process industry.

4. Electrolyte: 183000 tons of electrolyte will be shipped in 2019, with little change in the competition pattern

The output of electrolyte in China is increasing continuously. In recent years, with the maturity of lithium battery industry, domestic lithium battery electrolyte has entered the market since about 2002 and gradually replaced imported products. According to the research of the Institute of Lithium Electricity (GGII), the electrolyte shipment in China in 2019 was 183000 tons, up 30% year on year.

Domestic electrolyte manufacturers include Xinzhoubang, Tianjin Jinniu, Dongguan Shanshan, Zhuhai Saiwei Electronics, Guangzhou Tianci and other companies. Their products cover the high, medium and low end markets, basically meeting the needs of China's lithium battery production, and some of them are exported.

[Relevant individual shares]

300750CATL

The company occupies more than 50% of the overall domestic power lithium battery market share. In 2017, CATL's shipment volume ranked first in the world, and it plans to double its output by 2020. At present, its output utilization rate is still in short supply, and it is expected to become an important beneficiary in the rapid growth process of power lithium batteries.

On June 10, CATL said that the new battery uses self repair long life technology, which can achieve an extra long life of 16 years or 2 million kilometers, and the cost is no more than 10% higher than the current battery.

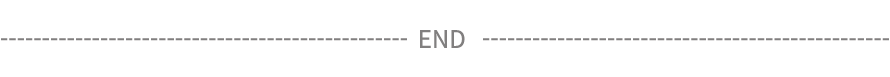

Lithium ForkLift Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium forklift batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

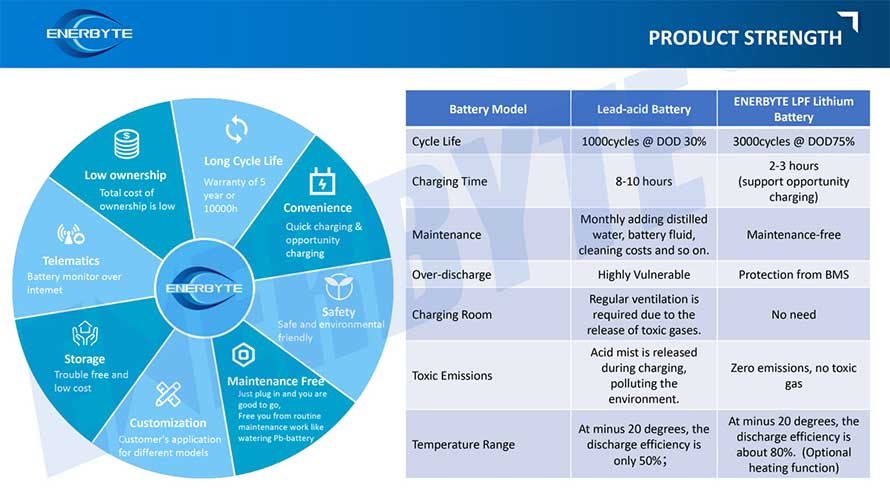

We have a comprehensive explanation of lithium batteries

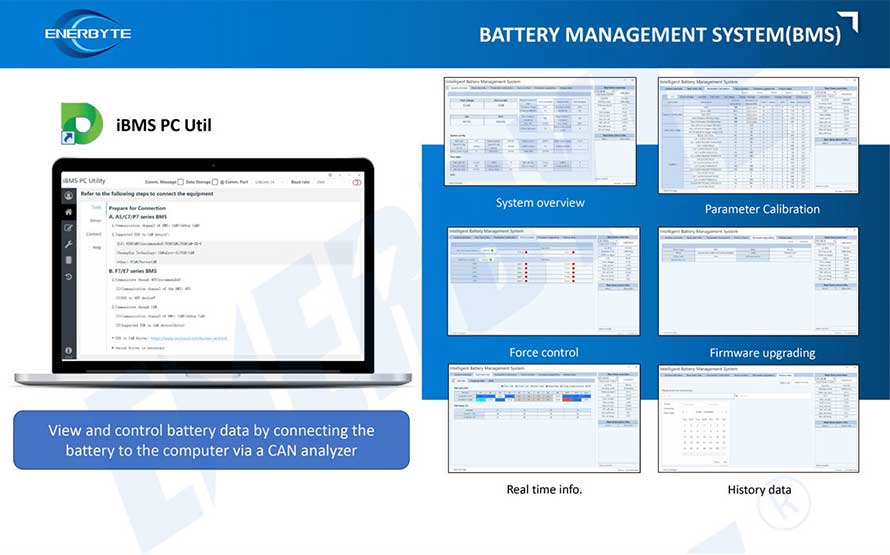

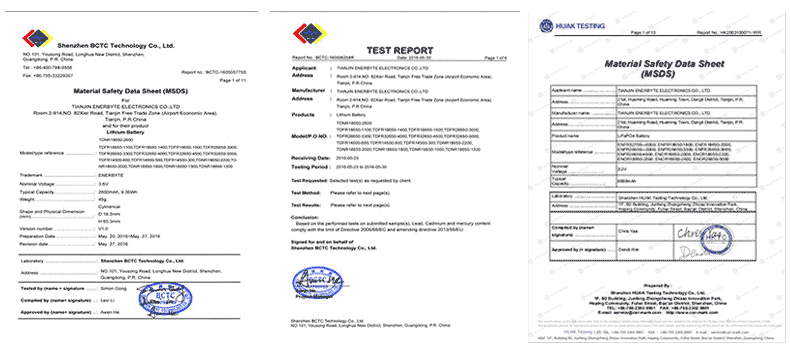

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

| Linde Lithium Forklift Battery | Toyota Lithium Forklift Battery | hyster Lithium Forklift Battery |

| jung Lithium Forklift Battery | enrich Lithium Forklift Battery | hyundai Lithium Forklift Battery |

| still Lithium Forklift Battery | heli Lithium Forklift Battery | hangcha Lithium Forklift Battery |

Service hotline

Service hotline