24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , lithium forklift battery manufacturer

The competition in the domestic new energy vehicle market is stagnant. According to incomplete statistics, there are currently nearly 300 new energy vehicles priced below 200000 yuan in China. Not only are there old players, but also some high-end car companies are planning to launch low-cost models to explore the mass market.

At the October financial report meeting of TSLA, it was announced that it would launch a low-cost electric vehicle with a cost price of half that of the Model 3 and a listing price of around 150000 yuan. Weilai is also planning to launch a third brand, covering the mid and low end markets of less than 200000 yuan. BMW also stated recently when talking about electrification that it will not leave the low-end market and will launch low-cost electric vehicles, which will become the core of BMW's business in the future.

Even BYD, which locked the sales crown in advance this year, plans to launch its cheapest pure electric model, the Seagull, to further explore the automotive market within 100000 yuan, and seize market share with models such as Chery Ant, Wuling Hongguang MINIEV, Infinite, and Zero Run T03.

Although high-end models have obvious advantages in profit margins, low-end vehicles have a wide audience and a large market share. After balancing technological progress and costs, they can have considerable prospects. However, as prices get lower and lower, in order to ensure a certain gross profit margin, car companies have to seek various ways to reduce vehicle costs. The cost of electronic control systems accounts for 65% of the cost of a new energy vehicle. The cost of power lithium batteries alone accounts for over 35%.

Battery has become one of the key factors restricting the price of new energy vehicles. According to statistics from Shanghai Iron and Steel Union, the average spot price of battery grade lithium carbonate rose by 2500 yuan per ton again, approaching the 600000 yuan mark, continuing to set a new record. Since September this year, the price of the important raw material for the production of this power lithium battery has risen by nearly 100000 yuan per ton.

As the prices of raw materials continue to rise, and under cost pressure, more and more automotive manufacturers are turning their attention to lower cost lithium iron phosphate (LFP) batteries. Since last year, a major change in the power lithium battery market has been that the proportion of lithium iron phosphate batteries installed in vehicles has exceeded that of lithium ternary batteries.

BYD announced this year that its vehicles will fully use LFP batteries; In July this year, Ford announced the purchase of CATL's flagship lithium iron phosphate battery for Mustang Mach-E and F-150 Lightning models that will be launched in the North American market in the next two years; In April of this year, Drew Baglino, senior vice president of engineering at TSLA, stated that about half of TSLA's factory vehicles are now equipped with lithium iron phosphate batteries. Rivian, a popular American electric startup brand, is also replacing some of its newly produced SUVs, trucks, and electric vans with lithium iron phosphate batteries.

Previously, due to a series of defects such as lower energy density, unsatisfactory range, and poor low-temperature performance compared to lithium ternary (NCM) batteries, most high-end brands were reluctant to list lithium iron phosphate batteries as the first choice.

As an iron based battery, lithium iron phosphate batteries can significantly reduce the consumption of lithium, while also preventing the use of rare mineral materials such as nickel and cobalt. The latter, as an important raw material for ternary lithium batteries, has also experienced significant price increases this year due to global supply chain shortages.

According to data from Benchmark Mineral Intelligence, a British research institute, the cost of lithium iron phosphate batteries has been around 30% lower than that of lithium ternary batteries in the past year. Ford Motor, which reuses lithium iron phosphate batteries, has stated that using iron based batteries can reduce the overall material cost of electric vehicles by 15%.

TSLA, which widely uses lithium iron phosphate to reduce costs, also achieved its first quarterly net profit surpassing Toyota in the third quarter of this year, and lowered its pricing in China this year in an attempt to seize more markets.

UBS analyst Tim Bush released his latest forecast that by 2030, 40% of electric vehicles worldwide will be equipped with lithium iron phosphate batteries, compared to an earlier forecast of only 15%.

In an August research report, Bush also stated that the industry generally underestimated the use of lithium iron phosphate, and that the addition of iron based batteries would be more helpful for automakers to diversify their batteries and effectively address supply chain shortages.

Low cost lithium iron phosphate batteries are the key for many brands to enter the sinking market.

Ford CEO Jim Farley said that iron based batteries are important in Ford's plan to supply consumers with more affordable trams. For BMW, which regards the low-end electric market as one of its core businesses in the future, lower cost iron based batteries will also be a better choice.

"In addition to some models that focus on long endurance, the cost of medium and low end electric vehicles may be more suitable for choosing lithium iron phosphate batteries, which is more practical for automotive manufacturers," Zhou Wenyu, Deputy Director of Fitch Bohua Industrial and Commercial Company, told InterfaceNews.

But this is not a long-term situation. Zhou Wenyu said that whether it's lithium iron phosphate batteries or lithium ternary batteries, the industry has been tirelessly seeking ways to reduce costs and further improve battery performance. The path may be to optimize the structure, such as increasing the utilization rate of cell volume to improve the energy density of the battery, or trying to increase or decrease other chemical elements to improve battery efficiency or reduce costs.

In July of this year, Aian announced the technology of Weijing super energy iron lithium battery. After adding microcrystalline active materials, the battery's endurance level reached 210 wh/kg, which is similar to the mainstream lithium ternary battery. The winter endurance has also been improved by 20%, effectively enhancing the core weakness of iron based batteries, namely, insufficient endurance.

Zhou Wenyu believes that the specific type of battery to choose in the future still needs to be judged by the manufacturer from the perspective of product demand.

Currently, the mining cost of most lithium resources in China is high, and there is a certain external dependence on upstream lithium resources. The investment in sodium battery research and development can help to select a diversified path for battery materials in the future. Zhou Wenyu told the interface news. She believes that domestic mainstream power lithium battery manufacturers will continue to invest R&D resources in new technology directions in the future, developing new products with lower costs and better durability and performance.

Ken Hoffman, co director of battery materials research for McKinsey Electric Vehicles, said that as raw material prices change and new technologies emerge, automakers may continue to adjust their battery strategies.

It is worth noting that at present, most of the global manufacturers supplying lithium battery power are located in China. Previously, CleanTechnica reported on the top 10 global power lithium battery manufacturers in 2022, including 6 from China, namely CATL (34%), BYD (12%), China Innovation Airlines (4%), Guoxuan High Technology (3%), Xinwangda (2%), and Fengchao Energy (1%), which together accounted for 76% of the global power lithium battery market.

There are not many advanced manufacturing industries with overwhelming global advantages in China, and power lithium batteries are one of them. China dominates the global production of power lithium batteries, including the mining and refining of raw materials. Benchmark Mineral Intelligence, a British consultancy, once estimated that China currently owns 75% of the global cobalt refining output and 59% of the lithium processing output.

When LFP batteries become the mainstream choice in the market, global automotive companies will also rely more on China's battery supply. "All intellectual property rights are in our country," Ford CEO Jim Farley told analysts in October. This is a constantly changing situation.

At the same time, battery manufacturers in Europe and the United States are competing to develop new batteries using two cheaper and richer materials, sodium and sulfur, to alleviate imminent supply bottlenecks, reduce dependence on China's supply chain, and promote the entry of electric vehicles into the mass market.

Lithium ForkLift Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium forklift batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

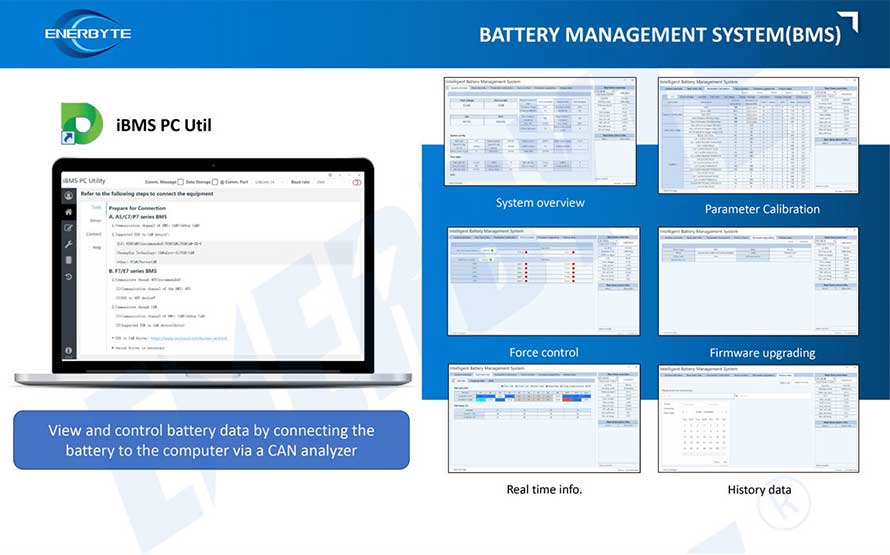

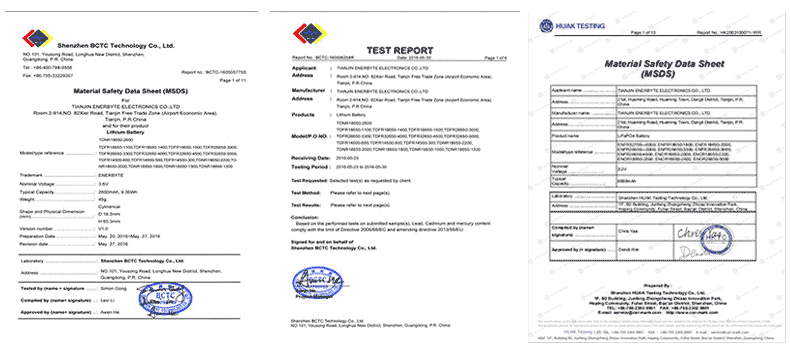

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

| Linde Lithium Forklift Battery | Toyota Lithium Forklift Battery | hyster Lithium Forklift Battery |

| jung Lithium Forklift Battery | enrich Lithium Forklift Battery | hyundai Lithium Forklift Battery |

| still Lithium Forklift Battery | heli Lithium Forklift Battery | hangcha Lithium Forklift Battery |

Service hotline

Service hotline