24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , lithium forklift battery manufacturer

Coincidentally, new energy vehicles are in a period of rapid development. This article analyzes from the perspective of the upstream, middle, and downstream of the industrial chain, and preliminarily believes that the trend in the upstream of the new energy vehicle industry is the acceleration of the localization process in key areas, with innovative development becoming the main tone; The trend in the midstream segment is that the industry is more focused on vertical acceleration of integration, and leading companies in the automotive industry are expected to emerge; The trend of downstream links will be the emergence of new users, new applications, and new technologies.

1、 New energy vehicle industry chain

The upstream of the new energy vehicle industry is mainly divided into three major sectors: firstly, the three electrical systems, including motors, electronic controls, and batteries; The second is the automotive sector, which includes automotive parts and components; The third is the intelligent system and corresponding hardware equipment.

The midstream of the new energy vehicle industry is important for the entire vehicle manufacturing process, the automotive aftermarket, and related operational support services.

The downstream link of the new energy vehicle industry is important for consumers.

Figure 1: New Energy Vehicle Industry Chain Diagram

This article aims to comprehensively evaluate the future development trend of new energy vehicles from the perspective of the upstream, midstream, and downstream of the new energy vehicle industry chain, combined with the current situation, pain points, and consumer market preferences of the new energy vehicle industry.

2、 Industrial development trends

(1) Upstream of the industry: The localization process in key areas has accelerated, and innovation and development have become the main theme

Under China's "dual circulation" strategic system, technological innovation and controllable supply chain security have become crucial tasks for China's next industrial development. China's automotive industry, especially the parts industry, has entered a new stage of "deep domestic substitution", from the joint venture model of whole vehicle assembly, interior and exterior basic parts, and core parts to the deep localization of high barrier core parts (domestic independent manufacturers replacing foreign or joint venture manufacturers).

Specifically, the breakthrough manufacturers in the segmented field are mostly private automotive parts listed companies. Previously, they had already achieved a leading position in traditional main businesses, achieving product supporting capabilities through product transformation and upgrading (high-end products, commercial vehicles to passenger vehicles), and external mergers and acquisitions (especially high-quality overseas assets). Cost advantages and customer preferences of independent brand vehicles are important factors in breaking the monopoly or dominant position of international manufacturers in the market. In addition, some international manufacturers may adopt a proactive exit strategy due to reasons such as industrial transformation and shrinking competitive advantages, which will also provide development space for domestic independent manufacturers to seize new territories. From this, we judge that the trend of "deep domestic substitution" will continue to strengthen in the future, with more successful cases similar to Fuyao Glass, growing from industry catchers to global supply giants.

Each component segmentation field has its own achievements. Based on the dimensions of bicycle value, industrial barriers, and market space, the components in the segmented fields of transmission, seat assembly, tire, light assembly, car wiring harness, airbag, steering, and brake assist system have achieved breakthroughs in supporting and are expected to achieve "deep domestic substitution". The important breakthrough point in the transmission field lies in the gradual matching of domestic brand automatic transmissions (AT, DCT, and CVT) with domestic brand passenger cars; The passenger car seat assemblies with high barriers and large market space have also made significant breakthroughs by domestic independent manufacturers. In addition, the trend of independent substitution in sub sectors such as tires, headlights, wiring harnesses, steering, and brake assistance has emerged and will continue to strengthen. Through the strategy of parallel extension and autonomy, domestic manufacturers are also expected to gradually gain market dominance in the field of safety airbags and their core components.

In addition, some domestic technology-based companies utilize their own technological advantages to accelerate technological empowerment or integrated development with key automotive components, and plan to break the monopoly of foreign high-end components through other technological and industrial paths.

Overall, the era of "deep localization substitution" for new energy vehicles in China has arrived, and the gradually improving level of domestic vehicle manufacturing will enable China's new energy vehicles to achieve strong competitiveness in the global new round of industrial competition.

(2) Mid industry: The industry is more focused on vertical acceleration of integration, and leading companies in the automotive industry are expected to emerge

Due to resource and environmental constraints, adopting new energy vehicles to replace traditional fuel vehicles has become a global consensus. It is expected that by 2030, the sales of electric vehicles in China will reach 48% of global passenger car sales. Based on this prediction, this article predicts that by 2025, global electric vehicle sales will reach 15 million units, and by 2030, global electric vehicle sales will reach 30 million units. It is expected that the global average annual compound growth rate of new energy vehicles will be 36.37% from 2021 to 2025, and 14.87% from 2026 to 2030.

Figure 2: Global New Energy Vehicle Forecast from 2020 to 2030 (10000 units,%)

Source: EVSales, Foresight Industry Research Institute Forecast

On the other hand, China's new round of revolutionary technologies such as artificial intelligence, big data, quantum computing, and autonomous driving have continuously made progress and been applied in the field of automobile manufacturing. The technological monopoly advantages of old car companies such as Europe, America, and Japan in terms of fuel vehicles will disappear, and Chinese car companies will have the opportunity to stand on the same starting line as international leaders. Domestic car companies, relying on their vast consumer market, well-established industry chain system, innovative advantages brought by engineer dividends, and corporate spirit, are expected to reach the pinnacle of the global automotive industry in a new round of competition and produce global leading companies such as Toyota and Volkswagen.

Therefore, this article believes that there will be three trends for domestic vehicle companies in the future.

One is that the new car manufacturing company is likely to surpass its competitors and become a top tier brand. Under pressure, have the ability and willingness to accelerate the research and development of new energy vehicles and continuously apply new technologies to automotive products. This type of car company is represented by the main engine manufacturers of domestic second tier brands. They not only have the historical heritage of traditional car companies, but also do not have the production burden of first tier car companies. They are likely to surpass their competitors and become first tier brands in the process of industrial upheaval. These car companies are the most resolute and exceptionally fast in their "gorgeous turn". Such as BYD, Great Wall Motor, Chang'an Automobile, etc.

The second is that the alliance between internet technology companies and traditional car companies is becoming increasingly close. Traditional car companies with strong automobile production capacity and familiarity with the automobile production process, but unable to invest in new energy vehicles, lack the ability of internet technology companies with internet technology, intelligent and intelligent technology, and new customer data to actually promote automobile manufacturing. The "OEM" ability of traditional car companies and the "black technology" ability of internet companies will accelerate complementarity, and their combination will inevitably build various fields within the industry The joint development of companies among various links has become a new force in the future new energy vehicle industry.

Thirdly, the entire vehicle industry will undergo rapid changes. Companies with insufficient production capacity, capital, and technological strength to support their transformation will be merged or eliminated. In the future, the operating performance and valuation of automotive companies will further differentiate, and the operating performance of new energy vehicle companies that can meet the needs of the public and continue to innovate will continue to rise rapidly. These companies will be able to gain market favor and receive higher valuation premiums.

(3) Downstream of the industry: New users, applications, and technologies will emerge as the times require

1. Accelerated integration of new energy and intelligent vehicles

Traditional fuel vehicles are basically composed of mechanical and hydraulic structures, while electric vehicles are simpler, with the core components being a three electric system consisting of a power lithium battery pack, an electric motor, and an EMS. Autonomous driving technology needs to control the vehicle, and the electric motor controlled by electricity can be combined with an electronic control unit (ECU) without much modification. In contrast, the pure mechanical structure of the engine makes it difficult for artificial intelligence to control its working state, whether it is reliability, accuracy, or responsiveness. It requires the development of new control devices, which is far more complex than electric vehicles. In addition, a significant portion of the cost of fuel powered vehicles comes from powertrain structures such as engines and transmissions, while the important cost of new energy vehicles comes from the three electric systems, electronic control, and electric drive batteries. In contrast, cost control for new energy vehicles is better.

Currently, the classification method developed by SAE International is widely used globally. According to the classification standards, autonomous driving is divided into 6 levels from L0 to L5, with L0 representing traditional human driving without autonomous driving, and L1-L5 being graded according to the maturity of autonomous driving. In the classification system of SAE, L0 to L2 are low-level driving systems, while L3 to L5 are advanced auto drive system. In the transition from L2 to L3, the most important aspect is the transformation of the environmental monitoring subject from the driver to the system. Only when the system is able to automatically detect and analyze the conditions in nearby areas can high-order autonomous driving become possible.

Figure 3: Intelligent classification and development trend of new energy vehicles

Source: Roland Berger, Prospective Industry Research Institute

Internet companies, technology companies, and new forces in car manufacturing have certain advantages in terms of electronic and electrical architecture. The upgrade of the automotive EEA architecture is important in terms of two dimensions: a strong communication architecture and a vehicle level computing platform. The traditional hardware centric vertical well development model of car companies is clearly not conducive to the iterative upgrade of EEA architecture, while the cross module horizontal development model of internet companies and new car manufacturing forces centered on functions is naturally conducive to the development of centralized EEA architecture, with accumulation in software. Therefore, its layout in centralized EEA architecture is clearly ahead of traditional car companies.

In the first half of 2021, Huawei not only released a series of HI (Huawei inside) new products that attracted widespread market attention, but also launched two new energy vehicles, the Celes SF5 and the Jihu Alpha S (Huawei HI version), in different cooperation models with Xiaokang and BAIC. The market response was enthusiastic, with the Celes SF5 having a pre order quantity of over 3000 vehicles in the first two days of sales.

Figure 2: Huawei Huawei Huawei Inside Series New Products

Source: Huawei official website, Forward Industry Research Institute

2. New energy vehicles will place greater emphasis on user experience

On the one hand, with the rapid development of the Internet and 5G technology, China's intelligent technology has been continuously applied in the automotive field, providing diversified supply options for automobiles; On the other hand, the per capita consumption level in China is gradually improving, and consumers' consumption demands and functional choices about cars are becoming more diversified, personalized, emotional, and interesting. According to research conducted by iResearch Consulting, factors such as pursuing a sense of technology, intelligent configuration, trying new things (fun and curious), and trends have begun to be reflected. With a new group of consumers becoming the main consumers, The considerations in this section will be even more important.

Figure 3: Reasons for Chinese Users to Purchase Cars in 2020

Data source: iMedia Consulting, Foresight Industry Research Institute

Therefore, with the continuous improvement of new energy vehicle technology in China, cars are gradually transitioning from mechanical drive to software drive. With the innovation of automotive electronic architecture brought about by electrification, the hardware system of cars will gradually become consistent, and software will become the key to meaning cars. The barrier to car building will evolve from the ability to assemble tens of thousands of components to the ability to run hundreds of millions of lines of code. The automotive industry is on the eve of a major transformation, just like the trend of functional phones developing towards smartphones. Leading concepts and software capabilities have become the most important core competitiveness. The rapid development of new car manufacturing forces such as TSLA, NIO, and Xiaopeng in recent years is a manifestation of this core competitiveness.

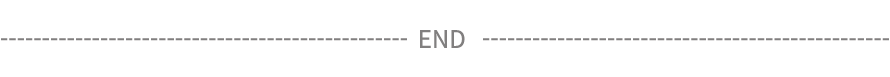

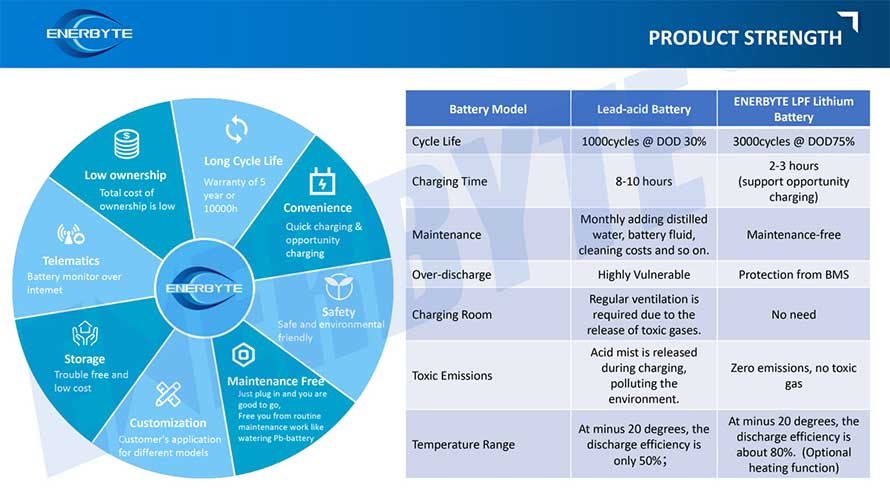

Lithium ForkLift Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium forklift batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

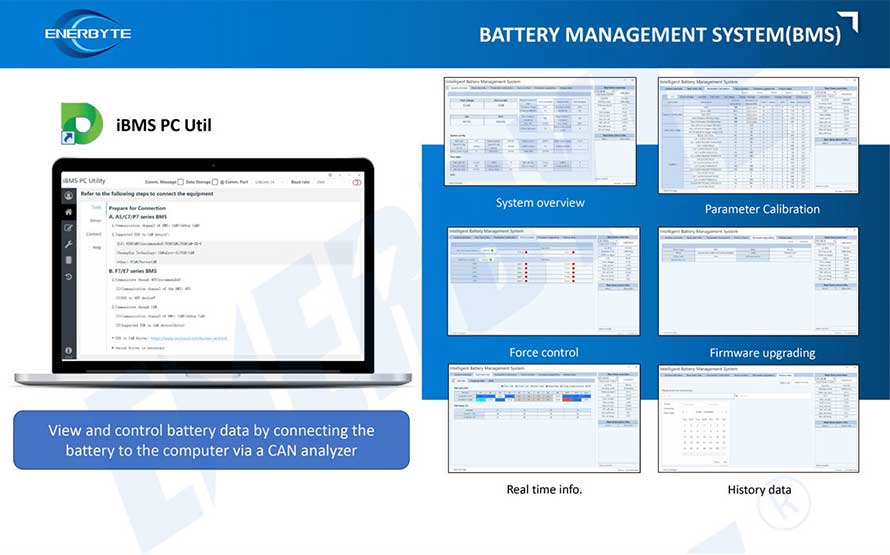

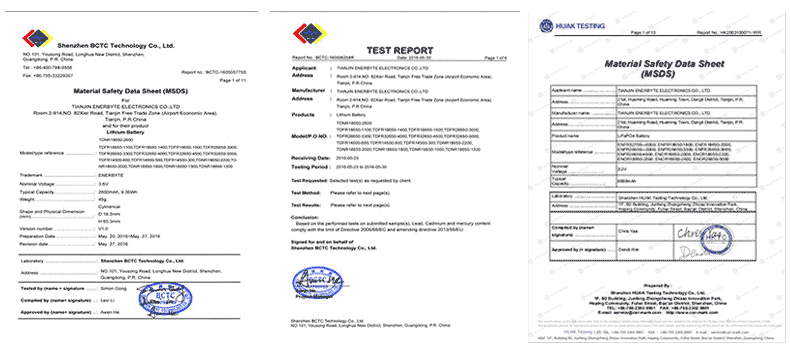

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

| Linde Lithium Forklift Battery | Toyota Lithium Forklift Battery | hyster Lithium Forklift Battery |

| jung Lithium Forklift Battery | enrich Lithium Forklift Battery | hyundai Lithium Forklift Battery |

| still Lithium Forklift Battery | heli Lithium Forklift Battery | hangcha Lithium Forklift Battery |

Service hotline

Service hotline