24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , lithium forklift battery manufacturer

Recently, the latest ranking of the market value of automobile manufacturers showed that BYD surpassed Volkswagen Group with a total market value of 129.23 billion US dollars and jumped to the third place on the list, becoming the only Chinese automobile manufacturing company with a market value ranking among the top ten automobile manufacturers in the world. On June 10, BYD's share price rose by more than 8%. As of that day, it had closed at 348.80 yuan/share, with a total market value of 1.02 trillion yuan, officially breaking through the trillion yuan threshold. So far, the market value gap between BYD and CATL, the "king of new energy" of A-share, has been further narrowed. On June 13, the market value gap between BYD and CATL narrowed to about 10 billion yuan.

As two giants in the field of new energy vehicles, CATL and BYD are often compared by investors. Since this year, BYD has never stopped chasing CATL. In the opinion of insiders, the rising sales performance of BYD has led to a strong rise in the share price, which means that the battle for the title of "the first brother" of batteries has been upgraded again.

BYD "Step by step"

In the eyes of insiders, BYD's market value exceeded the trillion yuan mark, which is a milestone. The self-sufficient supply chain system has brought BYD huge cost advantages. In the future, BYD's profit margin is expected to further improve.

Behind the trillion market value is a series of impressive reports such as orders, performance and supply. According to the data recently released by BYD, its new car sales reached 114943 in May, up 148.28% year on year, a record high. Since March this year, BYD has maintained a single month sales record of "100000+" for three months.

Similarly, BYD's performance in the power lithium battery business is also very eye-catching. In April this year, the market share of BYD power lithium battery increased by nearly 13 percentage points from 19.24% in March to 32.18%.

Cui Dongshu, the secretary-general of the Passenger Transport Federation, believes that BYD's sales volume has increased dramatically, which is recognized by the capital market. The important reason is that the technology has achieved a breakthrough. "After breaking through the electric hybrid technology, BYD has gained market recognition, and people believe that BYD's technology is advanced. In addition, another reason for the sharp increase in sales is that its supply chain is relatively stable and can resist some external risks."

Against this background, BYD's performance ushered in a strong outbreak. In the first quarter of this year, the revenue was 66.825 billion yuan, up 63.02% year on year; The net profit attributable to the parent company was 808 million yuan, a sharp increase of 240.59% year on year.

The two giants have their own advantages

The lithium battery industry is highly concentrated. The market share of the top five power lithium batteries exceeds 80%, of which CATL and BYD alone account for nearly 70% of the market share, and their competition has entered a white hot stage.

On the whole, both sides have advantages. Both CATL and BYD attach great importance to R&D, and the R&D investment of CATL has increased year by year in recent three years, which is significantly higher than that of other battery companies. Although BYD's R&D expense is higher than that of CATL, it flows not only to battery business, but also to automobile, electronics, etc.

In terms of battery technology route, CATL is in a leading position in material upgrading, structural process innovation and other aspects. Compared with the extensive layout of CATL, BYD's development goal is more focused: focusing on the structural innovation of lithium iron phosphate battery. The blade battery launched by the company is not inferior to CATL products in performance and output, and even appears to surpass.

According to the data released by China Automobile Power Lithium Battery Industry Innovation Alliance, in April this year, BYD's installed volume of lithium iron phosphate battery was 4.19 GW, up 5.3% month on month, and its market share rose to 47.1%, surpassing CATL for the first time. "Blade batteries have started to be supplied to the whole industry. In the future, blade batteries will be successively carried on new energy models of mainstream brands at home and abroad." Wang Chuanfu, BYD Chairman, said earlier.

However, compared with CATL, BYD has a weak layout in the field of ternary lithium batteries, and its production scale is far from that of CATL. CATL has previously disclosed that it plans to introduce ternary batteries of phosphate system, which will cost less than the current ternary batteries, but will still account for a certain proportion of the cost of new energy vehicles.

"The focus of battery business of BYD and CATL is different. BYD batteries are basically self supplied and deeply bound to its own vehicle business, which is more advantageous than CATL's binding to vehicle enterprises by way of equity participation. At the same time, BYD has long adhered to the iron lithium line, and refined a practical blade battery technology, which plays a role of 'mutual promotion of vehicle and electricity'." Cao Guangping, an independent researcher of new energy and intelligent connected vehicles, pointed out.

Numerous uncertainties

On the whole, although the market value of the two leading companies is not much different at present, CATL still has an overwhelming advantage in terms of loading volume. The data shows that in May this year, the installed capacity of CATL batteries was 8.51 GWh, up 67.5% month on month; However, when BYD's battery load was only 4.09 GW, the month on month decrease was 4.2%. The advantages of CATL's numerous customers, reflected in the market level, are reflected in the strong momentum of recovery.

"At present, CATL is basically in a dominant position in the domestic market. However, for auto companies, they prefer to support several battery suppliers that are close to each other in order to gain more voice." An industry expert told reporters that BYD batteries are currently accelerating their external supply, and its revenue scale and profitability are expected to further improve. The pattern of power lithium battery track may change.

Zhang Xiang, Dean of New Energy Automobile Technology Research Institute of Jiangxi New Energy Technology Vocational College, also expressed a similar view. He believes that auto companies are now actively seeking "de nirvana", such as Great Wall Self research Honeycomb Battery, Weixiaoli Investment Xinwangda, Volkswagen Investment Guoxuan High Tech, etc. "It is estimated that CATL's market share may decline to 30% in three years."

In addition to the market's intention to support many power lithium battery manufacturers, BYD's self-developed blade battery in 2020 also opens a new prospect for lithium iron phosphate batteries in the passenger car field. "The mainstream technology of power lithium battery is a 'cycle'. Ten years ago, the lithium iron phosphate battery led by BYD was originally the mainstream of the market, but by about 2014, the market began to use ternary lithium batteries to improve the battery energy density and ensure the endurance mileage. This pattern has changed again by 2021," said Zhang Xiang, "Blade batteries have lower cost, higher safety, and higher energy density. Since 2021, the loading of lithium iron phosphate batteries in passenger vehicles has exceeded that of ternary lithium batteries. In the field of commercial vehicles, lithium iron phosphate batteries are the mainstream batteries."

"According to this trend, BYD is likely to break the dominance of CATL." Zhang Xiang believes that as a strong point of CATL, the ternary lithium battery is not as safe as the lithium iron phosphate battery on the one hand, and its development may be limited due to the scarcity and price rise of nickel, cobalt and other cathode raw materials.

Lithium ForkLift Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium forklift batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

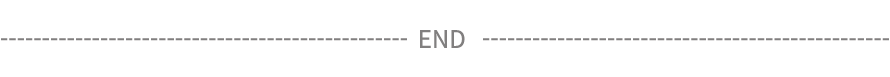

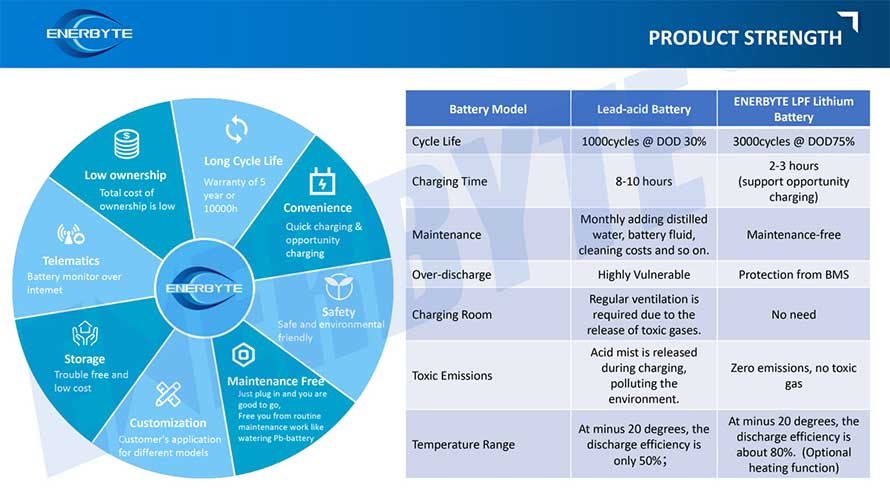

We have a comprehensive explanation of lithium batteries

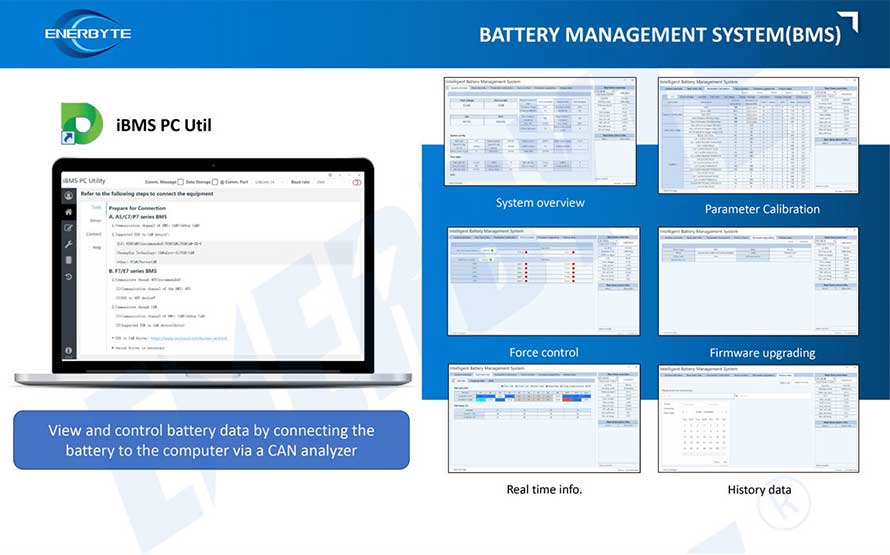

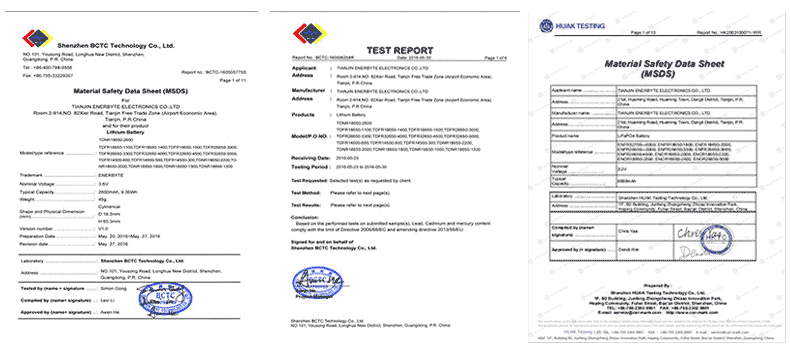

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

| Linde Lithium Forklift Battery | Toyota Lithium Forklift Battery | hyster Lithium Forklift Battery |

| jung Lithium Forklift Battery | enrich Lithium Forklift Battery | hyundai Lithium Forklift Battery |

| still Lithium Forklift Battery | heli Lithium Forklift Battery | hangcha Lithium Forklift Battery |

Service hotline

Service hotline