24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , lithium forklift battery manufacturer

China, Japan and South Korea "Three Kingdoms"

At the press conference of the financial report of Volkswagen Group, the CEO of Volkswagen Group Mueller announced a battery procurement plan of up to 50 billion euros. In China and Europe, the largest market, 20 billion euros of procurement has been reached, of which only two suppliers are shortlisted - one is China's Ningde Times, and Muller did not disclose the name of the other company, only said that it is from South Korea. Volkswagen's procurement plan shows the current market pattern in the battery field.

In addition to China and South Korea, Japan, also in East Asia, is also a strong presence in the battery field. For example, its domestic Panasonic has long been famous for supporting Tesla. Battery manufacturers from China, Japan and South Korea have formed the strongest team in the world.

In 2017, among the top ten global power battery enterprises, Chinese enterprises accounted for seven places, accounting for most of the market share. Japan and South Korea only had Panasonic, LG and Samsung, and the shipments of the three companies were 10GWh, 4.5GWh and 2.8GWh respectively.

Since the lithium ion battery industry was born in the early 1990s, it has been about 30 years. At the beginning, it was monopolized by Japan, and then Japan and South Korea competed for hegemony. Now, China, Japan and South Korea stand on top of each other. Looking at the current lithium battery industry pattern, China, Japan and South Korea will continue to compete for hegemony for a long time in the future.

Ningde era

At present, the global power battery market has been dominated by five Asian companies for a long time. Including Ningde Times, Panasonic, Samsung, LG and BYD.

Ningde era is located in an inconspicuous and nameless suburb of Ningde. This third-tier city in the southeast of China is unlikely to become the forefront of the technological revolution, but the enterprise born here is expected to surpass Tesla, Samsung and other established manufacturers.

While Tesla is high-profile in grabbing the page of the newspaper, Chinese battery manufacturers have made significant progress in battery technology.

According to the 2017 China Unicorn Enterprise Development Report released on March 23, Ningde Times ranked sixth with a valuation of $20 billion and became a super unicorn enterprise.

In addition to the Ningde era, Tianjin Lishen and BYD also followed closely. With the active support of the government, Chinese battery companies are beginning to take advantage in the industry dominated by Japanese and Korean companies (such as Panasonic) for 30 years.

As automobile manufacturers increase their investment in electric vehicles, lithium-ion batteries will become the key technology in the next 10 years at least. According to industry estimates, the scale of this market will reach US $40 billion by 2025, and it will be dominated by China.

In 2013, China surpassed South Korea and became the world's largest supplier of lithium batteries for electronic equipment.

One year later, with the take-off of China's electric vehicle market, lead prices rose. In 2016, the Chinese market sold 507000 electric vehicles and plug-in hybrid vehicles, an increase of 50% over the previous year.

Data shows that although Panasonic is still the world's largest supplier of electric vehicle batteries, China's Biya

Duncan Goodwin, head of global resource equities at Barings, fund manager, said: "The Japanese invented this technology, the Koreans expanded the scale and put it into production, and China will eventually dominate the market, because this is the final direction of the market."

According to the data of Bloomberg New Energy Finance, if Chinese battery companies can achieve the goal, they will be able to produce 121GW of batteries by 2020.

By contrast, when Tesla reaches full capacity in 2018, its target is 35GW.

One unit of GWh will be enough to supply 40000 electric vehicles for 100 kilometers.

The research and development department of Ningde Times has 1000 employees. The company has more than 2000 battery-related patents. Industry analysts said last year that they expected the company to "catch up with global peers in product quality".

On March 15, Ningde Times (or "CATL" for short) also won the "Boldnessin Business Awards" of the Financial Times in 2017. As a leading power battery system and energy storage system enterprise in the world, with its business courage and innovation that is not afraid of challenges, it won the "Most courageous emerging market enterprise award", and became the first new energy vehicle lithium battery enterprise to win the award since the award was established ten years ago.

Battery industry

The polarization of the power battery industry has formed technical barriers. The first-movers have cost advantages and customer barriers, and have also formed the main moat of the industry. Therefore, in the power battery field, some latecomers have announced to give up.

For example, a few days ago Bosch, the world's largest auto parts manufacturer, announced that it would give up its own power battery units and purchase them. In the future, it will provide a complete battery system through its own battery management system technology and system integration capability.

Previously, Bosch invested about 400 million euros a year to try to make a breakthrough in the field of electric travel, most of which was used for the research and development of battery technology. In December last year, Bosch said that it was considering investing 20 billion euros to make its battery capacity reach 200 GWh by 2030 to fight against competitors from Asia. Since last year, giants including Nissan and NEC have begun to withdraw from the lithium battery business.

"The biggest risk of making batteries comes from the market, technology and resources." Yu Puritan, the secretary general of the Zhongguancun New Battery Technology Innovation Alliance and the chairman of the Battery 100 People's Association, said that in the future, the world will not lack the best batteries, but the core materials and resources. With the development of raw material market, capital has become the key driver of a new round of competition. "Bosch and others are very rational to give up the investment in batteries."

In recent years, it is not uncommon for NEC to withdraw from the lithium-ion battery business. In addition to Bosch, last August, NEC decided to withdraw from the lithium-ion battery business and sell its subsidiary NECEnergyDe-vice, which produces electrodes, to China's private equity investment fund GSR Capital. This subsidiary mainly produces electrodes for the on-board battery of Nissan's pure electric vehicle "LEAF", with an annual sales of about 15 billion yen.

In addition, the joint venture battery subsidiary of Nissan and NEC, Automotive Energy Supply (AESC), was also sold to Jinshajiang Capital. AESC's contribution proportion is 51% for Nissan, and 49% for NEC and NECEnergyDevice. At that time, Nissan would first acquire 49% of AESC's shares from NEC, fully hold AESC, and then package and sell it to Jinshajiang Capital.

AESC purchases electrodes from NECEnergyDevice to produce batteries, with annual sales of about 30 billion yen. In 2016, AESC ranked fourth in the world after Panasonic, BYD and LG Chemical with 1622MWh of shipments. Therefore, at that time, the sale of AESC was seen as another blockbuster in the global power lithium battery industry after Sony (47.99, -0.35, -0.72%), the elder of lithium battery, withdrew from the battery business. Its sales volume is believed to be around 100 billion yen.

With regard to Bosch's withdrawal from lithium battery business, Bosch said that at present, the global power battery market is dominated by five major Asian companies for a long time. Including Ningde Times, Panasonic, Samsung, LG and BYD. These companies have achieved great success. If Bosch put battery cells into production at this time, it will take great market risks.

Secondly, at the cost level, 75% of the cost of a battery cell comes from lithium and other raw materials. With processing, packaging, transportation and other costs, the profit margin is very limited. Once the price war is set off by competitors, it is easy to lose everything.

Yu Puritan said that the top ten battery manufacturers have accounted for 70% of the Chinese battery market. These battery manufacturers have a complete layout on the four key materials. However, Doctor and NEC, including Benz, Daimler and Volkswagen, do not have resource advantages in the Chinese market. Materials are all purchased from China, so they have no confidence in cost.

In addition, from the perspective of investment, the reason for Bosch to give up is also obvious - after Bosch's careful consideration, it believes that the global power battery capacity will reach 1000GkWh by 2030. If Bosch wants to reach 20% of the market share, it needs to invest at least 20 billion euros to purchase the production, testing, recycling and other equipment of battery cells. This huge investment is under great pressure for any component enterprise. Once there is a revolutionary innovation in technology, the initial investment is likely to become a sunk cost.

At present, the energy density of lithium batteries, which are mainly liquid electrolyte, cannot fully meet the demand of electric vehicles. Bosch plans to "overtake on the curve", and will invest in solid-state battery and the next generation of lithium battery technology, but it is expected to mature by 2025. Yu Puritan said that unless there is a very obvious subversion in materials, lithium batteries will remain the mainstream power batteries for at least the next three to five years. The innovation and replacement of other technologies still have a long way to go.

The industry will face deep reshuffle

Although Chinese enterprises have occupied most of the market in the field of power batteries, they still rely on government subsidies to a large extent. Now, with the decline of government subsidies, this situation is likely to change.

Japan and South Korea have factories in China for battery production, and are waiting for the policy to be lifted. At present, Panasonic has set up two factories in Dalian and Suzhou, China. The Dalian factory produces square batteries. At present, the first phase of the project has been put into operation. Suzhou factory produces 18650 cylindrical batteries. Samsung has a factory in Xi'an, and Samsung SDI battery factory is put into operation in Xi'an. Its production line will produce 40000 high-performance automotive power (pure electric EV standard) batteries annually. In addition, LG's factory in Nanjing can provide more than 550000 battery products and about 180000 new energy vehicles.

In fact, many plug-in hybrid vehicles in China are currently equipped with batteries from Japan and South Korea, which is not very good for Chinese battery companies. On the other hand, China's power battery has not been a very successful international case.

Ningde Times plans to build a factory in Europe this year, but the address has not yet been selected. From the perspective of the "super" orders of Volkswagen, its attitude towards Chinese batteries is still exclusive to China. The "going out" of Ningde Times still depends on the "noble person" of its growth - BMW Group, which has helped Ningde Times quickly become the leading power battery supplier in China by introducing technical standards.

Of course, Bosch's withdrawal from the battery business does not mean that it will give up this market. It will continue to increase its research and development efforts in battery system integration and other aspects. In the future, Bosch will continue to make efforts in three projects: system integration, energy efficiency core and standardization. This is the ability that many battery manufacturers do not have at present. In addition, the research and development of next-generation batteries will also make Chinese enterprises feel the pressure in the future.

In the view of the industry, the refined division of labor will become the development direction of the battery field in the future. In 2019, China will begin to implement the new energy vehicle credit policy, which will be the turning point for the real popularization of electric vehicles.

Under the two-wheel drive of "market and policy", the implementation of the double-point policy, the schedule of banning the sale of fuel vehicles, the continuous improvement of infrastructure such as charging piles and power resource allocation, the improvement of power battery energy density and cost reduction, and the growth of the energy storage industry... Under this background, Yu Puritan believed that the market competitiveness of the battery industry chain would be greatly improved.

"The gap between China and Japan and South Korea in terms of technology route is gradually narrowing." According to Puritanism, Chinese battery companies are likely to surpass Samsung, LG and Panasonic in the future. On the one hand, Chinese battery companies will acquire relevant technologies from the market through various ways, including mergers and acquisitions. On the other hand, China, which has the largest battery market in the world, is likely to formulate standards and rules through its own voice after the technology is mature.

Under the background of accelerated production expansion and intensified competition of the leading power battery enterprises, the lithium battery new energy industry is bound to usher in a new round of deep reshuffle.

Lithium ForkLift Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium forklift batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

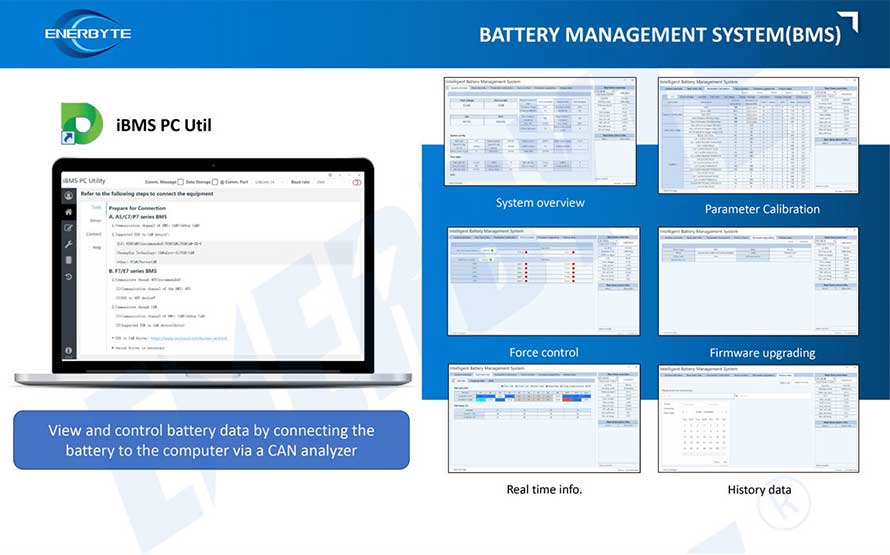

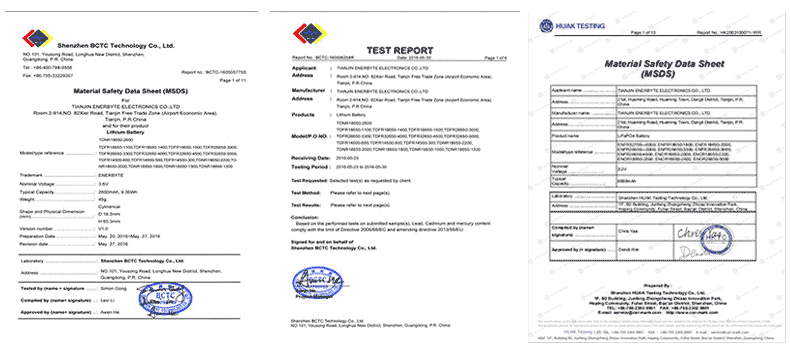

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

| Linde Lithium Forklift Battery | Toyota Lithium Forklift Battery | hyster Lithium Forklift Battery |

| jung Lithium Forklift Battery | enrich Lithium Forklift Battery | hyundai Lithium Forklift Battery |

| still Lithium Forklift Battery | heli Lithium Forklift Battery | hangcha Lithium Forklift Battery |

Service hotline

Service hotline