24-hour hotline:+8613662168047

Keyword search: battery plant , lithium battery factory , power bank works , lifepo4 battery mill , lithium forklift battery manufacturer

Recently, at the 2022 High Tech Lithium Annual Conference, Liu Jincheng, Chairman of Yiwei Lithium, stated that it is expected that there will be overcapacity in the entire industry chain in the latest year, while the only battery product that will not be surplus with high quality and low cost will not occur.

The direct reason for the excess production is that there has been a strong demand for power lithium batteries in the downstream in the past two years, driving a wave of large-scale expansion of production of upstream batteries and raw materials. The lucrative profit prospects also stimulate more and more other companies to join in and want to take a share.

In fact, Yiwei Lithium once again planned to expand production, and the market has already begun to express concerns. Everyone knows that at a certain point in the future, if the growth of new energy vehicles falls short of expectations, the production of lithium batteries will completely exceed the demand for new energy vehicles. At that time, a price war will inevitably be inevitable, which will worsen the competitive landscape of the industry and affect the valuation level.

This has already been reflected in the valuation level of upstream companies.

01. Overproduction in the entire industrial chain cannot be prevented

Since this year, news about the production or commencement of construction of power lithium batteries has been popping up almost every few days. According to this rhythm, the output stack is a huge number in terms of the current installed capacity.

According to estimates by Gaogong Lithium Battery, this year, China's power lithium battery shipments will reach 490GWh, an increase of 117%. From January to October of this year, the cumulative production of power lithium batteries reached 425.9 GWh, up 166.5%. As of September 2022 this year, the output of the national power and energy storage battery base is planned to exceed 5000 GWh (including more than 4800 GWh of lithium power batteries).

The scale of investment is also staggering. According to incomplete statistics by the China Times, in 2022, at least 75 investment plans were announced in the field of power lithium batteries, with a total investment amount of over trillion yuan, of which nearly half of the project investment scale was over 10 billion yuan.

Overproduction is a matter of high probability.

The impact of overcapacity is on the entire industrial chain, and in fact, many upstream material prices have already started to loosen against the background of production expansion.

According to the estimate of the High Industry Research Institute, the production plan for important lithium battery materials by 2025 has been fully surplus, and the planned total production of negative electrode materials by 2025 is equivalent to 5 times the estimated demand of that year, with lithium iron phosphate being 4 times, electrolyte, 6F, VC, PVDF, and copper foil being more than 2 times, and the barrier film being about 1.5 times.

In the first 10 months of this year, only lithium carbonate and nickel sulfate prices rose; The price of VC has fallen by 75%, PVDF, 6F, and cobalt sulfate have fallen by 40% or more, and the price of 6-micron copper foil has fallen by 20%.

In the past two years, each segment of the track has been crowded with a large number of competitors. At the same time, the bargaining power in the downstream battery field has become increasingly high, and the competition for orders has become white-hot.

Taking lithium iron phosphate as an example, due to the rapid increase in the shipment volume of lithium iron phosphate batteries and the increase in the proportion in the field of power lithium batteries, the supply of lithium iron phosphate cathode materials is in short supply, and the price has risen, and the company's enthusiasm for expanding production has increased. It is not uncommon to cross borders. Many phosphorus chemical, titanium dioxide, and carbon material companies, relying on their own raw material advantages, have successively arranged the production of lithium iron phosphate, iron phosphate, and other materials, hoping to take a share.

In 2022, the investment enthusiasm of lithium iron phosphate related projects will not decrease. According to the statistics of Battery Network, among the 24 newly announced investment projects, 21 projects have announced investment amounts, with a total investment amount of about 76.645 billion yuan and an average investment amount of about 3.65 billion yuan.

In fact, there are many reasons why companies are willing to invest heavily in producing power lithium batteries. In addition to the increased production of new energy vehicles and the increased demand for batteries, profit is only one aspect.

Currently, the prices of lithium ore and lithium carbonate in the upstream are still high. If midstream companies need to have a certain price tolerance to compete for orders from automotive companies, how can they maximize their cost sharing and scale effects?

Yes, it depends on stacking production.

Many companies are willing to sacrifice some profits in exchange for an increase in order volume. This confidence stems from the improvement in production utilization. Although they are all working for the upstream, the midstream is not yet selling batteries at a loss.

Secondly, the decline in the price of lithium battery production line equipment in recent years has also lowered the entry threshold for the entire industry. The combination of scale effects and the localization of equipment components has led to a significant decrease in the cost of lithium battery equipment. Currently, the investment price for a single GWh production of domestic lithium battery production lines has decreased from about 1 billion yuan to less than 240 million yuan, with a significant decrease.

Moreover, the investment boom in power lithium batteries is also related to the active investment promotion by local governments. The battery projects of high-quality companies can bring higher taxes and employment prospects to local governments, so it is easier for battery companies to obtain better conditions for investing and building factories in local areas. In short, local governments welcome power lithium battery projects, especially high-quality battery projects. If they compete to emulate and compete, then increasing the production scale is a mutual achievement of both sides. Currently, the planned battery production in Changzhou, Jiangsu, Jingmen, Hubei, and Yibin, Sichuan all exceeds 300 GWh.

02. Structural overcapacity

Looking at the medium to long term, as the growth rate of new energy vehicles in the downstream shifts, investors' concerns about whether battery demand can continue to rise at a high speed are also established.

The majority of power lithium battery production is used in the field of new energy vehicles. According to the current sales plans of major domestic mainstream automotive manufacturers, the sales volume in 2025 will exceed 18 million vehicles, and based on the capacity ratio of 60 kWh per vehicle, the maximum annual sales volume is only 1080 GWh. Moreover, these sales plans themselves reveal overly optimistic expectations.

During the period of the strongest demand for power lithium batteries, the penetration rate of domestic new energy vehicles quickly climbed from less than 10% to over 20%, only taking more than two years. In October this year, the penetration rate of new energy vehicles in a single month has exceeded 30%, and the annual sales volume is expected to exceed 6.5 million vehicles.

Starting next year, the market may be in a different situation. First, car purchase subsidies are about to be canceled, and the new costs will naturally burden consumers. However, many car companies are even struggling to achieve this year's sales targets.

The overseas new energy market is in the ascendant, and vehicle companies are beginning to roll into the foreign market. Some power lithium batteries will also be exported overseas. Therefore, perhaps next year, there will be a surplus of power lithium batteries for electric vehicles in China.

Secondly, one of the consequences of excessive production piling is that product quality is mixed, and the utilization rate of backward production is low, making it impossible to achieve profitability. Many new entrants believe that investing money to start the production line can produce batteries, but it cannot solve many issues such as technology, cost, and safety. "The quality cannot keep up with the upstream and downstream demand, and this batch of products has been reduced in price and no one is using them. It is also inevitable to eliminate them.".

However, the products of first-tier battery companies have undergone long-term downstream validation, and their relationship with downstream customers is more stable. Advanced production is expected to maintain a tight balance. Some market segments still have strong demand, such as the energy storage battery market, where terminal scenarios have differentiated requirements for cell capacity and life. In particular, the high-quality production of 280Ah large energy storage cells is even more scarce with the construction of large-scale energy storage projects in full swing, and this year it has also been looted by the downstream.

While new entrants are still piling up lithium iron phosphate batteries, some companies are already researching more advanced battery materials. Companies such as CATL, German Nano, and Dangsheng Technology have started investing in the industrialization of lithium manganese iron phosphate batteries. Lithium manganese iron phosphate has higher voltage, higher energy density, and better low-temperature performance than lithium iron phosphate, and is rich in manganese ore resources. Compared to ternary materials, lithium manganese iron phosphate has lower cost, higher cycle times, and a more stable structure.

In addition, there are next-generation battery technologies such as sodium batteries and vanadium batteries, which are expected to weaken the demand for outdated battery production.

03. How to make adjustments?

The demand for power lithium batteries may be three times that of China's new energy vehicles, as Ouyang Minggao, an academician of the Chinese Academy of Sciences, once speculated. With the development trajectory of global renewable energy power generation, new energy vehicles, and energy storage in recent years, it is not difficult to understand the judgment basis of academicians.

China's power lithium battery companies have moved from inner roll to outer roll.

This year, the export of domestic power lithium batteries has risen very rapidly. From January to October this year, China's export of power lithium batteries has exceeded 100 GWh, reaching 105.3 GWh. Most of the difference between production and domestic loading is used for export. Among them, established automotive companies in developed regions such as Europe and the United States have higher verification requirements for battery quality and performance, and they should take into account the attributes of green manufacturing. This shows the advantage of advanced production of China's leading companies.

In addition to Northern Europe and China, the new energy vehicle market in most regions is still in the introduction stage, with a huge demand for lithium battery power. The domestic lithium battery industry chain has production and cost advantages compared to foreign countries, which is not easily weakened by foreign companies returning to China. Although some non market factors may cause resistance to China's lithium battery exports, lithium battery companies have begun to invest and build factories overseas in recent years, thereby ensuring the supply of products and services. Since the beginning of the year, companies such as CATL, Xinwangda, Yiwei Lithium Energy, Guoxuan Hi-Tech, and Vision Power have successively announced that they have received orders for power lithium batteries from overseas automotive companies, with a cooperation signing period of 3-5 years.

Secondly, the use of power lithium batteries is related to the more profound and broad energy revolution. Renewable energy consumption requires energy carriers to store energy in order to suppress power generation volatility and improve energy utilization efficiency. Terminal power users use electricity to hedge price fluctuations by storing electricity to reduce power consumption costs. Storage is relatively dependent on the form of electrochemistry, with the advantage of being able to quickly achieve charging and discharging. In recent years, the cost has gradually decreased and the economy has become prominent, accounting for nearly 90% of the total.

According to the prediction of CITIC Securities, the global demand for energy storage batteries will reach 500GWh in 2025. Energy storage batteries require less energy density than automotive batteries, and can actually handle some relatively inferior battery production. In the expansion plan for power lithium batteries, although batteries used for energy storage account for a small portion of the production, they are essentially lithium batteries, which does not preclude the possibility that battery companies will adjust their direction based on the degree of demand.

04. End

From the above perspective, the planning objectives may be proposed in a larger narrative context and can be used for market value management and local preferential policies, but the actual development goals still need to be realistic.

Overproduction is a common phenomenon in the capital cycle. As the development of downstream industries gradually enters a stage where more emphasis is placed on quality and product innovation, the advanced production formed through technological iteration and upgrading in the lithium battery industry chain will appear even more scarce, and the actual effective production will also be far lower than the planned production.

However, the valuation foam in the stock market that have been propped up through planned output and future imagination may also be coming to a test.

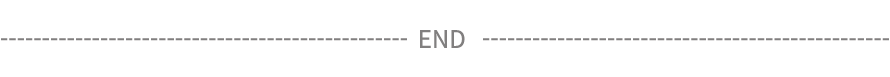

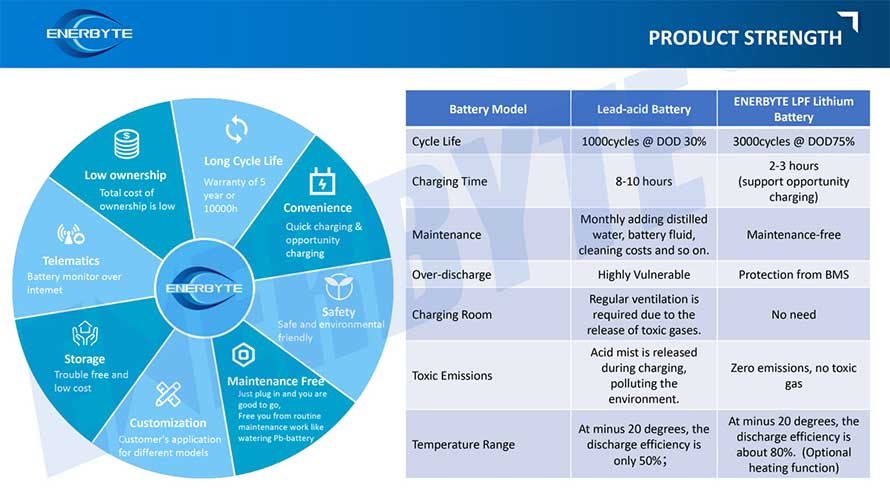

Lithium ForkLift Batteries ,Ensure Quality

Our lithium battery production line has a complete and scientific quality management system

Ensure the product quality of lithium batteries

Years of experience in producing lithium forklift batteries

Focus on the production of lithium batteries

WE PROMISE TO MAKE EVERY LITHIUM BATTERY WELL

We have a comprehensive explanation of lithium batteries

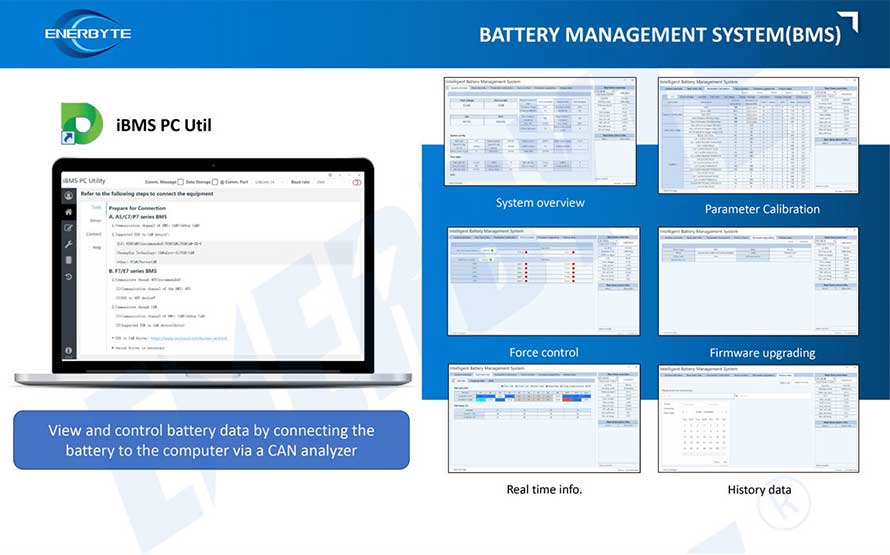

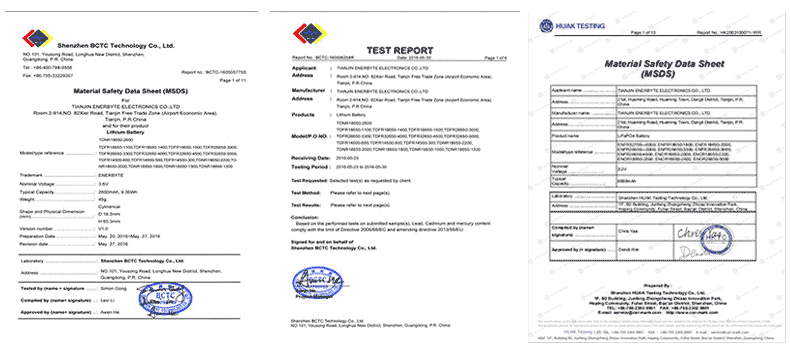

QUALIFICATION CERTIFICATE

THE QUALITY OF COMPLIANCE PROVIDES GUARANTEE FOR CUSTOMERS

MULTIPLE QUALIFICATION CERTIFICATES TO ENSURE STABLE PRODUCT QUALITY

Providing customers with professional and assured products is the guarantee of our continuous progress.

Applicable brands of our products

| Linde Lithium Forklift Battery | Toyota Lithium Forklift Battery | hyster Lithium Forklift Battery |

| jung Lithium Forklift Battery | enrich Lithium Forklift Battery | hyundai Lithium Forklift Battery |

| still Lithium Forklift Battery | heli Lithium Forklift Battery | hangcha Lithium Forklift Battery |

Service hotline

Service hotline